Market Outlook: Market Rally Reduces Return Outlook | First Quarter 2019

by: Smith and Howard Wealth Management

In a nutshell: Investors have understandably enjoyed the stock market rebound this past quarter and positive returns in bonds; however, both moves reduce our future return expectations. For equities, the return to average valuation levels during the previous quarter was short lived. The strong recovery in equity markets again means that valuations have returned to more elevated levels. Bonds, in which we’d seen a gradual increase in yields and expectations the last few years, saw that reverse as bond yields dropped meaningfully late in the quarter.

An In-Depth Look at Our Outlook

The Big Picture

It is no secret that we strive to execute on the simple, but difficult to execute, philosophy of “buy low, sell high.” We stick to this philosophy for good reason: shifting portfolios towards inexpensive assets and away from expensive ones “wins” over the long term. So, while it is interesting to speculate and debate about near-term events and breaking news, ultimately, investment returns are driven by valuations.

Equity Outlook: Return to Expensive Side of History

Throughout most of 2018 we expressed our belief that equity market valuations were elevated. We were not alone in that belief and debates typically centered not around if the market was cheap or expensive, but just how expensive it was. Few investors could credibly argue equities were cheap. As we wrote in our 4th quarter 2018 CFO Report, that began to change as prices dropped in October and again in December. The question today is obviously: What do valuations look like now after global equity markets bounced impressively off their lows from late December?

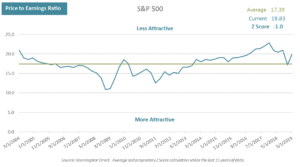

As the Price to Earnings Ratio graph illustrates, the S&P 500 Price to Earnings multiple dropped significantly during the 4th quarter and then quickly reverted back to higher levels during the 1st quarter of 2019. In our January CFO report, we expressed our belief that the 4th quarter selloff had only driven valuations back to more “fair” levels and markets hadn’t gotten meaningfully cheap. With the quick snap back in equity markets, valuations are once again rich or on the expensive side of where they have been historically. We stress that this doesn’t necessarily mean negative returns over the next quarter, year, or market cycle, only that long-term returns from here are likely to be lower than they have been historically.

As the last six months have certainly shown us, valuations can change quickly. To illustrate just how quickly they can change, we’ve included a chart showing some of our Absolute Z Scores for U.S., International Developed, and Emerging Market equities at the three most recent quarter end periods. Z scores above 0 indicate a valuation that is cheaper than the historical average and scores below 0 indicate a more expensive valuation. In terms of magnitude, scores don’t become overly meaningful to us until they approach +/- 1.

The path of each score is consistent across each market segment. While each started the period at a different valuation level (grey bar), they all became more attractive due to the 4th quarter selloff (green bar). With markets rallying during the 1st quarter we are now seeing scores revert back to less attractive levels (blue bar).

Fixed Income Outlook: More Headwinds Moving Forward

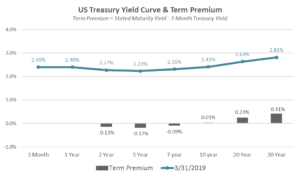

The strong returns in bonds during the quarter were driven by a decrease in bond yields across the yield curve. That tailwind for bonds now becomes a headwind as we think about future bond returns. The story in bonds, however, is as much about the “shape” of the yield curve as it is the overall level of yields. This is illustrated in the US Treasury Yield Curve & Term Premium graph. Our recent description of what an inversion of the yield curve means or signals for investors can be found here. The summary version of our view on an inversion of the curve is that while it is clearly not a positive, it is also not something that should create panic for investors. Regardless of what happens with economic growth, the current level of bond yields puts a rather low ceiling on future bond market returns.

Investors could historically target or strive for higher bond returns by buying longer maturity bonds or taking on more credit risk. With the yield curve flat to inverted, the higher yields in longer dated bonds are not meaningful or even available (see Term Premium grey bar).

What about credit? While there is still a pickup in yield by taking on more credit risk, that additional yield pickup (something the industry terms credit spread) is not as high as its been in the past. Investors can still find some ways to increase their bond portfolios yield, but this naturally comes with a higher level of risk.

For more insight as to how a market rally can reduce future return expectations, contact Brad Swinsburg, 404-874-6244.

Explore more information on the first quarter of 2019 by visiting these links:

Market Recap: First Quarter 2019

On the Horizon: First Quarter 2019

A Deeper Dive: First Quarter 2019

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.