Summary | First Quarter 2019

by: Smith and Howard Wealth Management

Summary

One of the more destructive behavioral traits of investors is their tendency to extrapolate. Extrapolation is the idea that investors form beliefs about future performance by extrapolating past performance. They assume that whatever the recent trend has been will continue well into the future. There are many things in life that play out in that manner, but investing typically is not one of them. The past two quarters have been a stark reminder of that.

Anyone doubting the destructive nature of extrapolation should look no further than the 4th quarter of 2018. The wild equity market swings, particularly in December, were a sign that many investors simply “threw in the towel” fearing that the slide would continue. Investors who succumbed to those fears missed out on the best quarter for stocks in a decade and the best start to a year since 1998.

Investors tend to extrapolate both negative and positive returns, so today we find ourselves in a very different position than just three months ago. Just as we urged clients not to panic previously, we are urging them today not to get too comfortable. As advisors we often find ourselves preaching patience and moderation, never getting too low when markets are down nor too high when they are up. Both can be difficult positions to be in, but if we had to choose, trying to temper expectations when things are up sure beats the alternative!

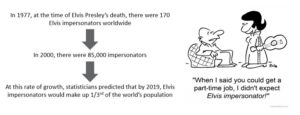

On a more humorous note, we thought you may enjoy this example of the foolishness of extrapolation that was a part of the Training the Investor Brain series by Brandes Institute. Information originally sourced from UK-based Murderousmaths.

Contact Brad Swinsburg, 404-874-6244 for more information on the impact of extrapolation.

Explore more information on the first quarter of 2019 by visiting these links:

Market Recap: First Quarter 2019

Market Outlook: First Quarter 2019

On The Horizon: First Quarter 2019

A Deeper Dive: First Quarter 2019

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.