Summary: Third Quarter 2018

by: Smith and Howard Wealth Management

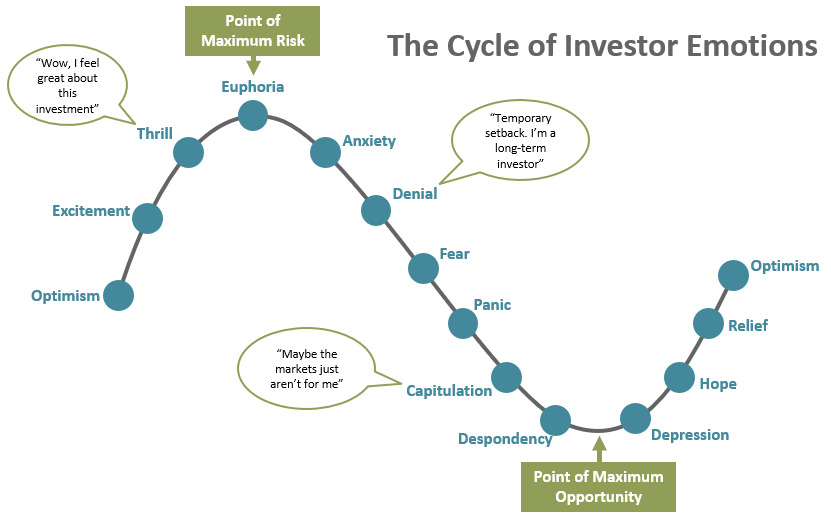

“Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.” – Sir John Templeton

We’ve noted throughout our commentary that valuations remain elevated and that investors likely need to temper expectations for future returns. While clearly not an overly optimistic outlook, it should also not be viewed as a dire one or a signal that markets are on the verge of falling.

Yes, we believe valuations are high, but we also recognize that they can remain so for extended periods of time and reach greater extremes before returning to more “normal” levels. The tech bubble is a great example. Markets were expensive for several years before the bubble burst and valuations went far beyond what we’d have considered expensive before “correcting”. The reason that valuations may at times reach extreme levels has more to do with investor psychology than anything else. As the quote from Sir John Templeton states, investors and markets go through a cycle of emotions. Not to be outdone, of course, Wall Street has expanded on his eloquent quote. Below is one illustration of the cycle of investor emotions.

So where are we in this cycle? It is impossible to know exactly, but it is probably safe to assume we are somewhere between Optimism and Euphoria. Strong returns and a growing economy have fed plenty of optimism, but not euphoria (in our opinion). We may have seen euphoria in niche areas like cryptocurrencies and cannabis stocks, but neither resembles the kind of large, systemic risks of tech stocks in the late 90’s or real estate during the financial crisis. With investors still perhaps edging towards Excitement, Thrill or Euphoria, markets could certainly continue to move higher. We obviously hope that they do! Hope, however, is not an investment strategy and we must remain disciplined in taking risks where we believe we are best being compensated for that risk and not getting drawn into the game of attempting to time the market. Call Brad Swinsburg 404-874-6244 to discuss the cycle of investor emotions in more detail.

Explore more information on the third quarter of 2018 by visiting these links:

Market Recap: Third Quarter 2018

Market Outlook: Third Quarter 2018

On the Horizon: Third Quarter 2018

A Deeper Dive: Third Quarter 2018

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.