Market Outlook: Outlook for Returns Still Challenged | Second Quarter 2019

by: Smith and Howard Wealth Management

In a nutshell: Higher prices in both stocks and bonds continue to challenge our future return expectations. As value investors, we believe that valuations drive returns, so when prices increase at a faster rate than underlying earnings or yields, it results in lowering our expectation of future returns. Valuations in both stocks and bonds appear expensive relative to history; with both expensive at the same time, investors must think differently in structuring portfolios, managing risks, and looking for opportunities.

An In-Depth Look at Our Outlook

The Big Picture

It is no secret that we strive to execute on the simple, but difficult to accomplish philosophy of “buy low, sell high.” We stick to this philosophy for good reason: shifting portfolios towards inexpensive assets and away from expensive ones “wins” over the long term. So, while it is interesting to speculate and debate about near-term events and breaking news, ultimately, investment returns are driven by valuations.

Equity Outlook: Returns and Valuations Continue to Climb

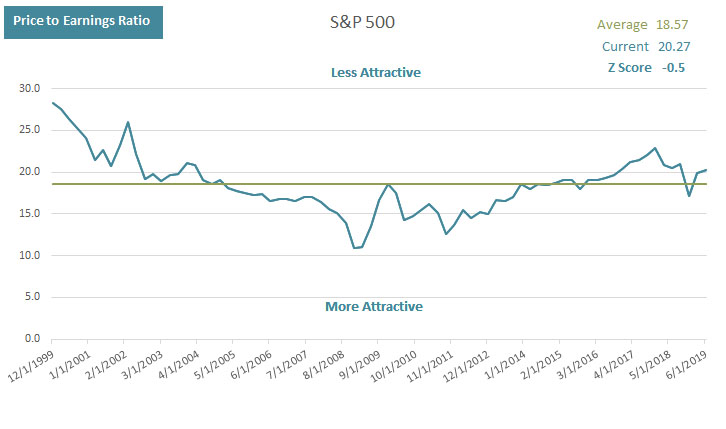

The S&P 500 posted its best first half to a year since 1997. The impressive increase in stock prices was not matched by a commensurate increase in earnings, however, which means that valuations continued to climb. After beginning the year at reasonable valuations, the strong upward move in U.S. and most international equity markets over the last six months means that valuations are again on the high side of historical averages. As the Price to Earnings Ratio graph illustrates, the S&P 500 Price to Earnings multiple climbed to 20.27, well above the 18.57 average experienced since the turn of the century.

We stress that a higher Price to Earnings multiple doesn’t necessarily mean negative returns over the next quarter, year, or market cycle, only that long-term returns from here are likely to be lower than they have been historically.

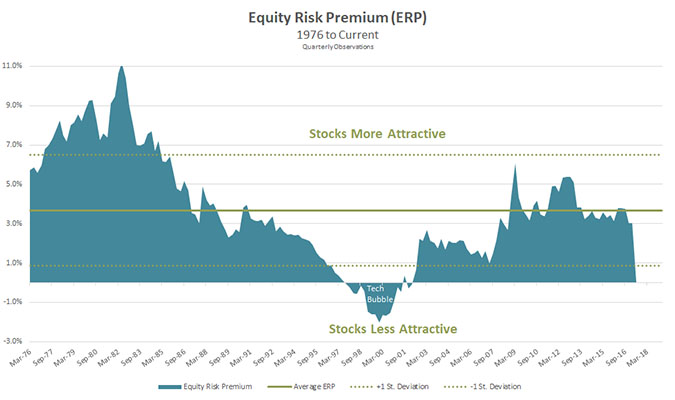

A somewhat silver lining for equities is that relative to bonds, stock prices are only “slightly” expensive. In prior Your Family CFO Reports we’ve discussed the concept of the Equity Risk Premium or ERP (for a detailed explanation click here). The concept behind the ERP is that before an investor accepts the additional risk inherent in stocks relative to bonds, they should demand or expect a higher return. In the illustration below, we are showing what investors are demanding today, as well as the longer term average. The current equity risk premium of 3.0% may be lower than the historical average of 3.62%, but it is not abnormal or even negative like we saw during the tech bubble.

This is specific to the U.S. large cap stock market and U.S. government bonds. We do find valuations outside of the U.S. to be more reasonably priced.

Fixed Income Outlook: More Headwinds Moving Forward

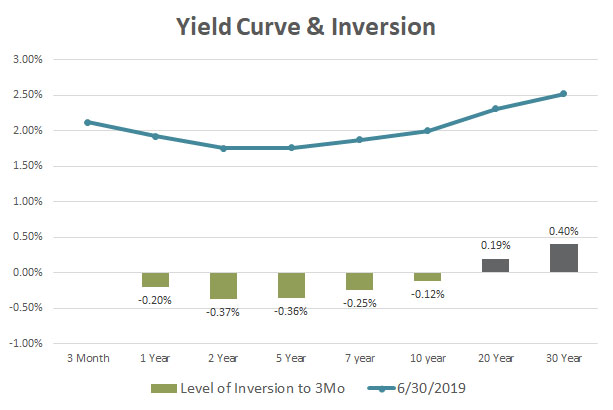

The story in fixed income closely resembles that from the first quarter of this year. A continued drop in bond yields across the yield curve resulted in strong returns and challenging yield levels or valuations going forward. Whilewe had been on the verge of a true yield curve inversion for several quarters, it was only during the most recent quarter that a meaningful and sustained inversion appeared. (A description of what an inversion of the yield curve means or signals for investors can be found here.) The summary version of our view on an inversion of the curve is that while it is clearly not a positive, it is also not something that should create panic for investors. Current bond yields do put a rather low ceiling on future bond returns regardless of what transpires with economic growth or Fed activity.

Investors could historically strive for higher bond returns by accepting or investing in bonds with greater maturity or credit risk. With the yield curve now inverted, the opportunity to increase returns by extending maturities is essentially removed, unless an investor is willing to extend maturities out to nearly 20 years or more.

Credit spreads remain tight but do still offer higher yields across the yield curve for investors willing to accept a higher degree of credit risk. The question with credit risk or spreads is not whether a bond can be purchased at a yield that exceeds that of a comparable, risk-free government bond, but by the amount that it exceeds it. Is that additional yield enough to compensate investors for the additional risk being assumed? The current amount of additional yield in higher risk bonds did get slightly more attractive during the quarter, but they remain somewhat expensive by historic standards.

The current environment continues to be challenging for investors and advisors. From a historical perspective, it is rare that both stocks and bonds would both be expensive at the same time. That doesn’t negate the benefits of diversification, but it likely reduces its benefits. As a result, investors and advisors must think differently in structuring portfolios, managing risks, and looking for opportunities. We continue to believe that international equity markets and non-traditional strategies offer some of the more compelling valuations, but investors must be willing to go where the opportunities currently are rather than where they’ve been in the recent past.

Contact Brad Swinsburg 404-874-6244 to learn more about the outlook for returns.

Explore more information on the second quarter of 2019 by visiting these links:

Market Recap: Second Quarter 2019

On the Horizon: Second Quarter 2019

A Deeper Dive: Second Quarter 2019

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.