Summary: Stocks Take a Breather in 3rd Quarter

by: Smith and Howard Wealth Management

After two very strong quarters for stocks to start the year, stocks took a breather during the 3rd quarter while bonds continued to power higher. Both markets were driven in large part by the ongoing U.S. / China trade discussions. Concerns related to those discussions held stocks back but were a boost to bonds as already low bond yields moved even lower. Overall the 3rd quarter may have lacked some of the excitement and positive returns of the prior two quarters, but most investors still experienced an increase to their bottom line.

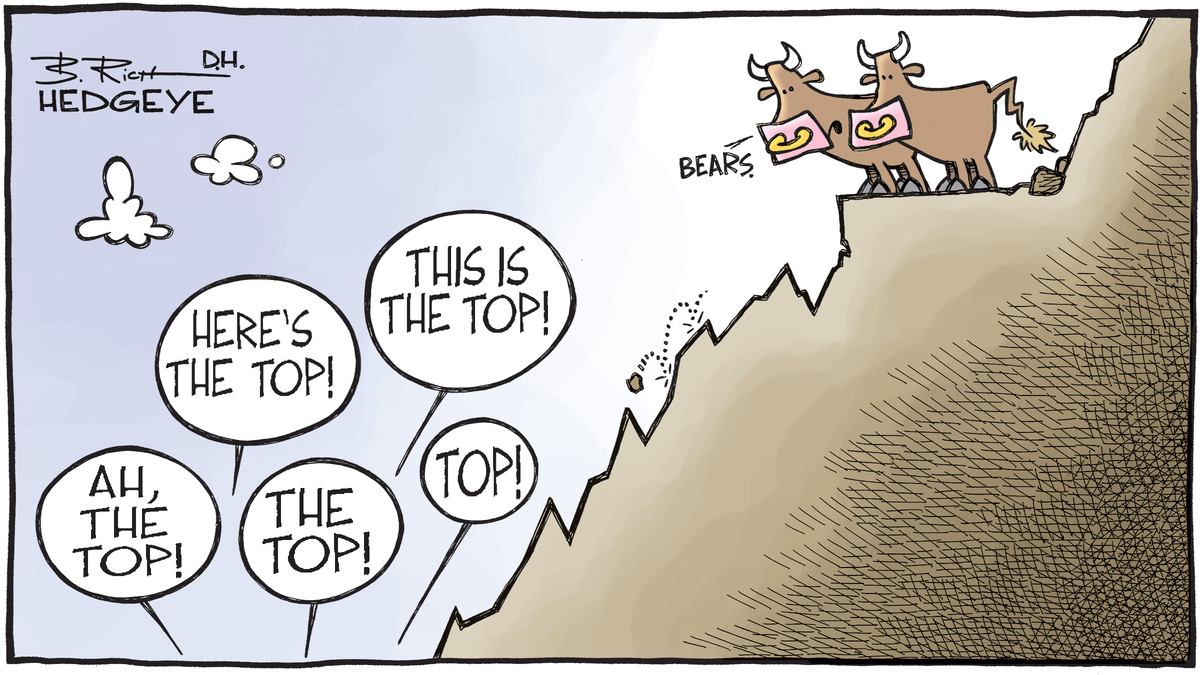

With U.S. markets near all-time highs and an economic expansion that is now the longest in U.S. history, it is easy to get caught up in the increasingly loud discussion of whether we’ve “seen the top”. As interesting as those debates may be, we believe an investor’s time is better spent focusing on valuations and understanding what they tell us about future returns. Pockets of opportunity still exist, but overall the current valuation landscape indicates long-term returns are likely to fall short of historical averages for most major market segments. That overall view drives our allocation approach as we look to capitalize on those remaining pockets of opportunity and avoid taking risks for which we are not likely to be adequately compensated.

Contact Brad Swinsburg if you would like to discuss any of the articles featured in our 2019 third quarter CFO report.

Explore more information on the third quarter of 2019 by visiting these links:

Market Recap: Third Quarter 2019

Market Outlook: Third Quarter 2019

On the Horizon: Third Quarter 2019

A Deeper Dive: Third Quarter 2019

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.