Outlook for Returns Remains Challenged: 3rd Quarter

by: Smith and Howard Wealth Management

Higher prices in both stocks and bonds continue to challenge our return expectations. As value investors, we believe that valuations drive returns, so despite (or because of) strong year-to-date returns in both asset classes, we maintain that future returns are likely to be below historical averages. Pockets of opportunity may exist, primarily within equities, but investors and advisors must think differently in structuring portfolios and managing risks in order to capitalize upon them.

Beyond the 3rd Quarter: An In-depth Look

The Big Picture

We strive to practice the simple, but difficult to execute, philosophy of “buy low, sell high.” We stick to this philosophy for good reason: shifting portfolios towards inexpensive assets and away from expensive ones “wins” over the long term. So, while it is interesting to speculate and debate about near-term events and breaking news, ultimately, investment returns are driven by valuations.

Equity Outlook: Expensive with Pockets of Opportunity

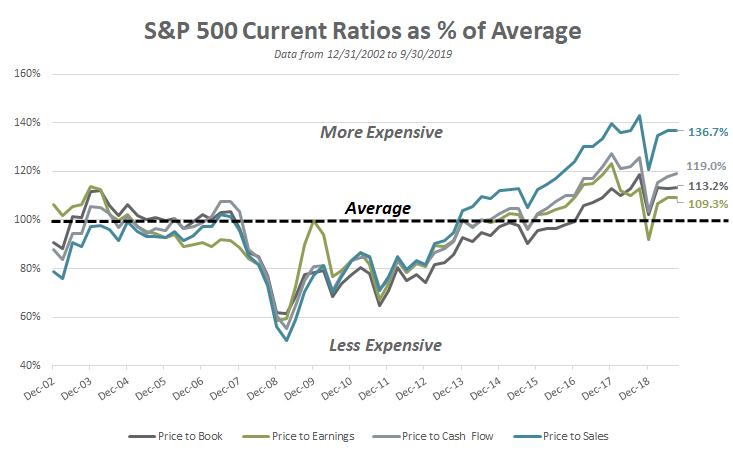

The S&P 500 ended the quarter at 2,976.74 – close to its all-time high. Unfortunately, record-high prices are typically accompanied by high valuations (i.e. expensive) and this time is no exception. As investors who believe that valuations provide a strong contra signal about future returns, we believe those high valuations portend lower future returns. As the following graph illustrates, the S&P 500 is more expensive today than it has been at nearly any point since the tech bubble. The graph shows four basic valuation ratios as a % of their nearly 20-year average. All four metrics currently exceed their average, some by a considerable amount (> 100%, more expensive).

As we continually stress to investors, valuations may be a good indicator of long-term returns, but they are a poor timing mechanism. We don’t believe in trying to time the market and urge our clients (and any interested investor) to consider the following:

Fixed Income Outlook: Headwinds Growing

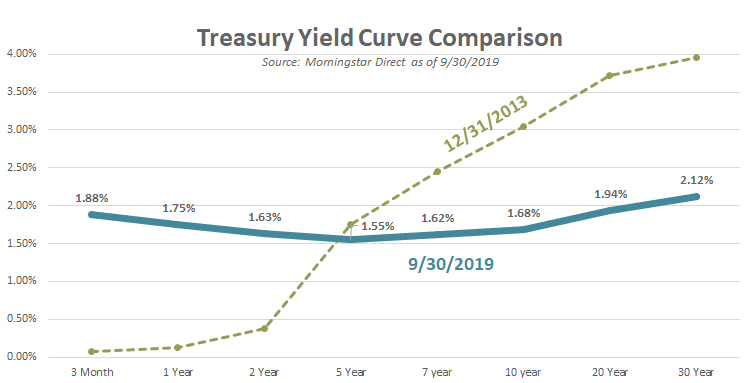

While equities may have silver linings, optimism within fixed income is harder to find. Outstanding year-to-date returns for fixed income have been driven by a drop in bond yields that have yields at nearly every maturity level back to historic lows. As an example, the yield on a 30-Year U.S. Treasury bond intra-quarter dropped below 2% for the first time ever! If inflation continues to hover around 2%, the best the buyer of that 30-year bond can hope to do during that time is breakeven after inflation.

As the Yield Curve Comparison chart shows, extending out or buying longer bond maturities no longer provides a meaningful increase in expected yield. What a difference just a few years can make!

Lengthening maturities may no longer offer increased yield levels or return potential but accepting a greater level of credit risk still does. We would not expect that relationship to change (i.e. higher credit risk results in higher yields to maturity at purchase), but investors do need to keep an eye on credit spreads. Credit spreads are the additional return or yield that an investor hopes to capture by owning bonds of less creditworthy issuers. That spread today is less than it has been historically which indicates a willingness by investors to take on more risk for increasingly less return.

The current environment continues to be extremely challenging for investors and advisors. From a historical perspective, it is rare that both stocks and bonds would both be expensive at the same time. That doesn’t negate the benefits of diversification, but it likely reduces its benefits. As a result, investors and advisors must think differently in structuring portfolios, managing risks, and looking for opportunities. We continue to believe that international equity markets and non-traditional strategies offer some of the more compelling valuations, but investors must be willing to go where the opportunities currently are rather than where they’ve been in the recent past.

Contact Brad Swinsburg 404-874-6244 with questions or to learn more about how Smith and Howard Wealth Management serves affluent individuals and their families.

Explore more information on the third quarter of 2019 by visiting these links:

Market Recap: Third Quarter 2019

On the Horizon: Third Quarter 2019

A Deeper Dive: Third Quarter 2019

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.