Market Recap + Outlook: Markets Finish Year On A High | Fourth Quarter 2019

by: Smith and Howard Wealth Management

In a nutshell: The momentum established in January 2019 was largely sustained throughout the year. U.S. and Global equities were up, with growth stocks outperforming value stocks. Bonds also saw an increase, albeit a smaller one than equities. A probable China trade agreement and an accommodating Fed continue to be tailwinds for equities. We still believe that investors should expect “more of the same” in somewhat lower returns as we’ve seen the last two years, rather than the 10-12% equity returns that have historically been cited as target numbers. We believe that pockets of opportunity still exist within equities, and that non-traditional strategies offer the ability to smooth returns during volatile periods, but investors must be willing to go where the opportunities currently are rather than where they’ve been in the recent past. It is our job – and our goal – to help our clients find these opportunities.

An In-Depth Look at the 4th Quarter and 2019

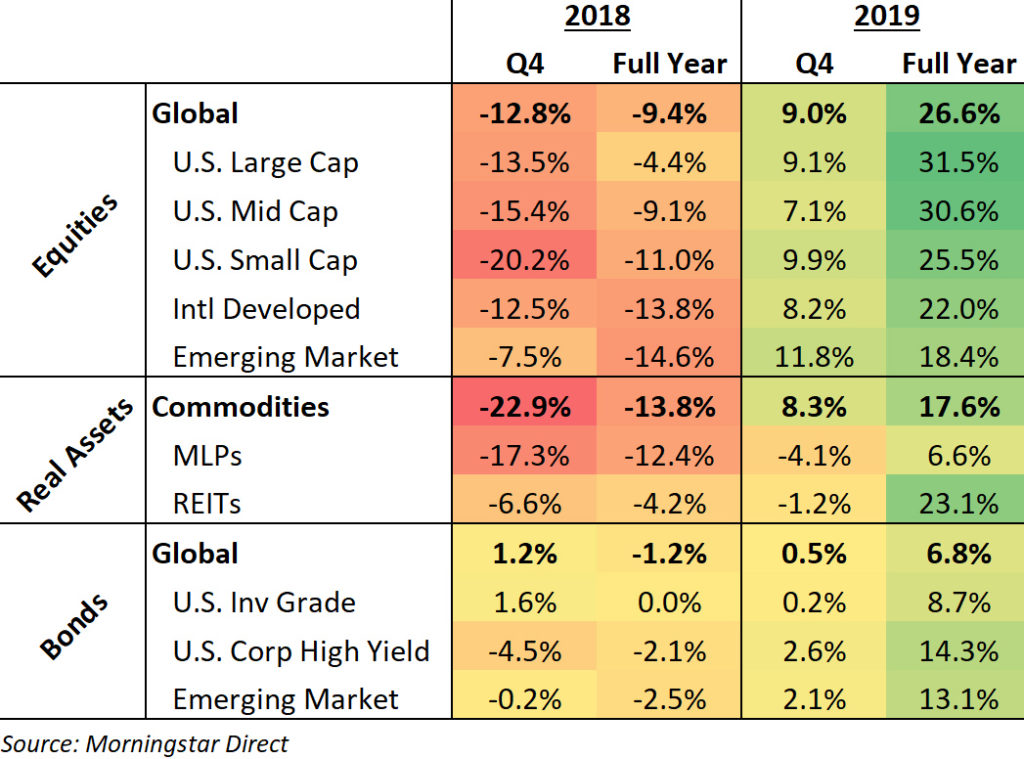

2019 is a reminder of how quickly investor sentiment and returns can shift. Large losses during the 4th quarter of 2018 had pushed nearly all major markets and asset classes into negative territory for the year. As a result, investors entered 2019 nervous about what might await them. In (happy) hindsight, we see that the end of 2018 marked the low point for markets and portfolios for the coming year, as January 2019 brought a dramatic and impressive turn and momentum that would largely be sustained throughout the year. In stark contrast to 2018, returns were strong across asset classes around the globe, resulting in new highs for most equity markets.

A look at our year over year comparisons will give you a glimpse into the dramatic turnaround from this time last year.

It is a given that returns vary by year, but the amount of variability in returns may at times surprise even the most experienced investors. Though the 4th quarter and individual year returns have been strikingly different over the last two years, the combined period returns on an annualized basis were relatively normal and in-line with or slightly better than our expectations. Global equities finished up +7.1% while global bonds returned +2.7%. Fortunately, U.S. based investors likely did slightly better in both areas as U.S. returns in stocks and bonds exceeded those of overseas markets.

Equities

Equity markets across the globe finished near their highs for the year (and in many cases set new all-time highs). Two primary influences of note that kept momentum positive into the 4th quarter:

Both of these developments were cheered by equity investors and helped continue the rally through quarter end.

Equity markets were positive across the board during the 4th quarter and the year, but as always there was dispersion between market segments. Here’s how it looked at year-end:

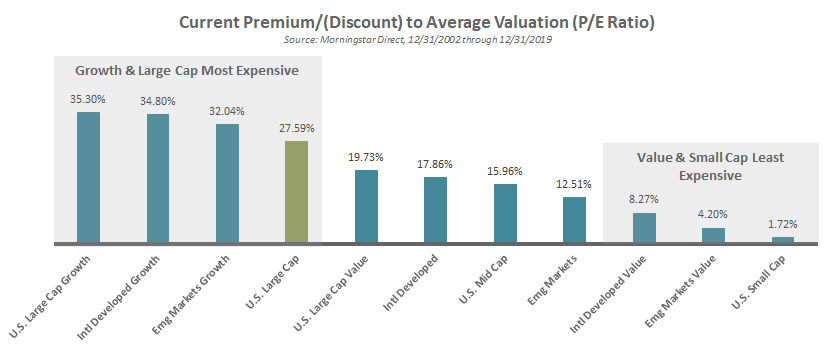

Equity investors often cite 10-12% as a reasonable long-term annual return target for equities based on historical precedent. We continue to believe that with valuations (P/E ratios) more expensive than normal in the U.S., investors should be prepared to experience something modestly below that target – a return keeping with the last two year period. As the graph below indicates, the S&P 500 (green bar) currently trades at a multiple of earnings that is 27.6% higher than what it has been on average since the end of the tech bubble. In fact, most every major market segment is trading at multiples or premiums to their averages over that period.

We believe, however, that investors who are willing to allocate less to those expensive markets and more to the less-expensive markets (see International Developed Value, Emerging Market Value, and U.S. Small Cap) may be able to achieve returns closer to the historical equity averages.

Bonds

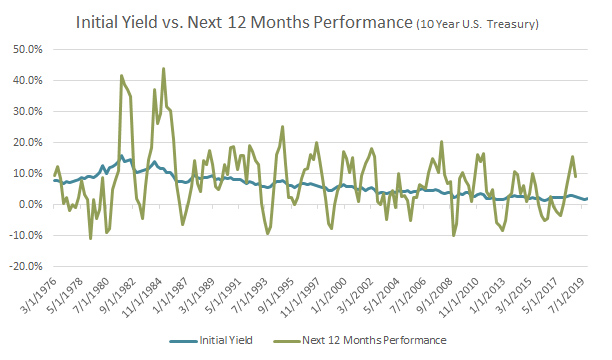

Bond returns, particularly for U.S. investors, far exceeded most reasonable return expectations for 2019. The Bloomberg Barcap Aggregate U.S. Bond Index returned a remarkable +8.72% during 2019. That return juxtaposes a yield to maturity for the underlying bonds in the index at the beginning of the year of just 3.28%. The “additional” return was primarily a function of falling overall bond yields as the yield on the U.S. 10-Year Treasury bond fell from 2.69% to just 1.92% at year end. Lower credit quality bonds such as corporate high yield and emerging market debt also posted strong returns as they enjoyed the added benefit of tighter credit spreads.

Long-term bond returns closely equate to an investor’s starting point yield to maturity. Significant deviations in that dynamic tend to be short-term in nature, as illustrated in the following graph.

Blue line: represents the yield to maturity of the 10-Year U.S. Treasury bond over time.

Green line: represents the rolling one-year return of that same bond.

Obviously, one-year returns can (and do) deviate quite significantly from that blue line or the actual stated yield to maturity of the bond. As you see, one-year returns that are higher than the blue line are often followed by returns that fall below the blue line (and vice versa). In thinking about 2019 returns and the pattern of the graph, it is no surprise that we do not expect a repeat of the exceptional bond returns of the last 12 months. We believe investors should be prepared to experience returns more in-line with the low overall yields to maturity of the current bond market.

Going Forward: Relying Less on Historical Trends

The current environment continues to be challenging for investors and advisors. From a historical perspective, it is rare that both stocks and bonds are expensive at the same time. That doesn’t negate the benefits of diversification, but it likely reduces its benefits. As a result, investors and advisors must think differently in structuring portfolios, managing risks, and looking for opportunities. We do believe that pockets of opportunity still exist within equities and that non-traditional strategies offer the ability to smooth returns during volatile periods, but investors must be willing to go where the opportunities currently are rather than where they’ve been in the recent past.

To discuss why we believe that non-traditional strategies offer the ability to smooth returns, contact Brad Swinsburg, 404-874-6244.

Explore more information on the fourth quarter of 2019 by visiting these links:

On the Horizon: Fourth Quarter 2019

A Deeper Dive: Fourth Quarter 2019

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.