Fighting the Home Country Bias

by: Smith and Howard Wealth Management

As my colleague Valerie Nichols recently discussed in her article, Finding Value Outside of the U.S., equity markets have enjoyed a significant performance advantage relative to the international developed and emerging markets for a number of years running. This performance dispersion has occurred a number of times throughout history and is cyclical with the “winner” rotating over time. Such cyclicality in returns presents a compelling opportunity for advisors and investors who are not only willing to resist the temptation to chase recent performance but to take advantage of it by selling what has outperformed and buying what has underperformed. Even the most seasoned investor knows that is never easy or comfortable. Taking advantage of this particular cyclicality is made even more difficult by the need to suppress or ignore another natural investor impulse – home country bias.

Home country bias is exactly what it sounds like. When selecting investments, investors have a strong bias towards owning securities from companies and institutions in their own home country. They also tend to favor companies and industry sectors that they are familiar with and often use the products or services of.

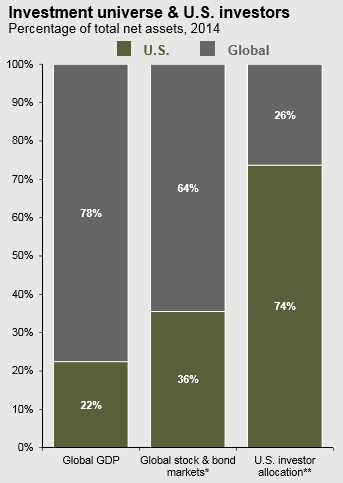

The graph on the left shows just how strong this bias is, at least here in the U.S. While the U.S. is the largest country from a global GDP and investment market standpoint, we still “only” account for 22% of global GDP and 36% of global stock and bond market capitalization. Dominant, sizeable positions, to be sure, but those percentages pale in comparison to the percentage allocation most investors have in US assets: 74%!

Given our dominant current economic position, depth and stability of markets, and the recent outperformance we cited earlier, many observers might simply assume that this home country bias is a U.S. specific phenomenon. They’ll be shocked to find that relative to some others, our home country bias is actually quite modest.

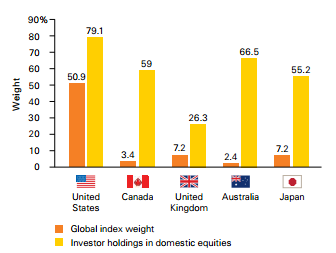

The graph below, from a recent Vanguard paper, shows just how pronounced this bias is in several other major economies and markets. The orange line shows the percentage weighting that each country’s equity market accounts for of the total global equity market. The yellow line shows the percentage weighting of that country’s investors in equities of their home country. Using Canada as an example, Canadian companies make up only 3.4% of the total global equity market, yet Canadian investors have chosen to allocate 59% of their equities to Canadian stocks!

While this is certainly a point-in-time observation, this home country bias has existed for as long as one could find the statistics to prove it. To be fair, there are actually quite a few reasons, several rational, that this bias exists and persists:

Those are some of the more sensible reasons, but the primary reason simply comes down to basic familiarity and optimism for ones’ home country – or home country bias. Investor biases, of which the home country bias is just one of many, are universally acknowledged to at a minimum be detrimental to investor returns if not downright destructive. Despite such widespread acknowledgment they continue to play a very significant role in driving investor behaviors and resulting investments. Hugh Massie, a behavioral finance strategist and founder of the firm DNA Behavior, believes that 93.6% of financial decisions are based on emotion (Financial Advisor Magazine, October 2016) an astounding figure for an industry so obsessed with data and analytics.

While the U.S. investors’ home country bias is obviously less pronounced than that of investors in many other countries, it nonetheless exists and warrants our attention as over the long-term it is almost certain to negatively impact portfolio returns.

As professional advisors, we must resist such biases while helping our clients be at a minimum conscious of them. We must also fight the urge to become complacent or comfortable in light of the strong equity returns our clients have enjoyed since the financial crisis of 2008-09. This brings to mind a quote from a well-known (granted, well-known in the geeky circles of quantitative investing!) investor, Rob Arnott, founder and Chairman of Research Affiliates:

“In investing, what is comfortable is rarely profitable.”

While it is important and helpful to review and reflect on 2016 results, our focus is always on the future and uncovering the next area of outperformance. We look forward to discussing where we see opportunities over the next cycle and how we are positioning to capitalize on them. As you have likely already been able to guess, international investing is bound to be part of that conversation!

If you’d like to discuss this, or any wealth management topic in more detail, please call me at 404-874-6244 or email me here. To read Valerie Nichols’ article referenced above, click this link.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.