The SHWM Difference: Taxes Matter

by: Smith and Howard Wealth Management

With so many investment and financial planning options available to individuals, it is important to understand what’s important when deciding on a provider. When people ask us why they should select Smith and Howard Wealth Management (SHWM) instead of any others, the basic answer is simple: we focus on the details that matter. In this article, Tim Agnew, CPA/PFS, CFP® and Managing Director of Smith and Howard Wealth Management, talks about the firm’s philosophy on taxes as a key piece of the overall financial life of our clients.

Many firms provide the same services we provide, but I have come to realize that most firms do not place the same amount of emphasis or thought into their approach. This lack of analysis or forethought can produce negative financial implications in the present or many years down the road. On the flip side, close attention to these details provide the best opportunity for realization of your pre and post-retirement goals. It just takes focus.

We are a team of experts that serve as the Chief Financial Officer (CFO) to our client’s family. As the family CFO, we are focused on preparing and analyzing the family’s financial picture – and making recommendations – the same way a CFO of a business would.

Why Taxes Matter – How Much Did You Put in Your Pocket?

The investment industry is extremely focused on returns, but these returns are measured pre-tax instead of post-tax. What we care about, and our clients care about, is how much money did they put in their pockets after-tax. Income taxes can erode one-third to one-half of the return earned on investments. For this reason, we constantly analyze ways to minimize taxes.

There are several primary areas we focus on for each of our clients when it comes to minimizing their tax liability:

By minimizing taxes, families save more and/or withdraw less from their portfolio. In meeting with families exploring new investment advisor relationships this year, it was clear that their current advisors did not consider income taxes nor recognize opportunities to reduce their income taxes.

Below are some examples of how we viewed individual situations and the related income tax issues.

Example:

We met with an individual whose assets were invested in separate accounts with separate managers. After our conversation and a review of their situation, some issues were apparent:

Their current advisor was using separate account managers that had been selected based on past performance and were now underperforming. Despite their under-performance, these managers had generated positive returns and had built-in tax gains. However, due to the underperformance, the prospect and the advisor had agreed to fire the managers and replace them with new managers who had recently out-performed the benchmark set by the advisor and individual. The sale of the underlying positions triggered substantial capital gains, requiring dollars to be withdrawn from the portfolio to pay taxes. In turn, this created a new lower starting point in terms of investment dollars with their new manager.

In general, we use a passive approach to investing in equites and prefer to vary our asset allocation instead of focusing on manager selection like the previously mentioned advisor did. A passive approach is considerably less expensive and more tax efficient than separate account managers. Also, under current tax law, asset management fees are not deductible. In reality, they have not been deductible for most taxpayers for years due to alternative minimum tax or itemized deduction limitations, but tax law has solidified that across the board. On the contrary, fees charged by managers structured as mutual funds or ETFs are fully deductible inside the funds and reduce taxable income.

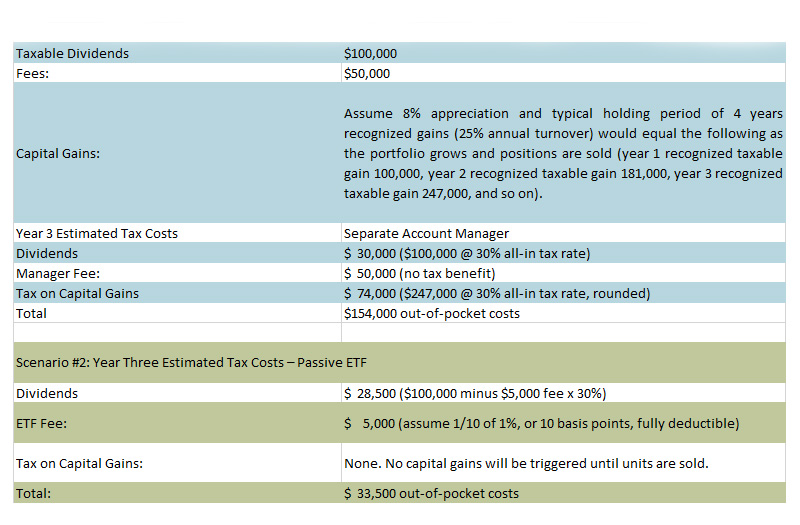

Here is a mathematical example of what all of this means. Assume $5,000,000 invested with a separate account manager in an all-equity portfolio where the owner is still accumulating assets. Further assume that the manager charges a 1% fee and that the dividend yield on the portfolio is 2%.

As you can see, in this basic example there is about a $120,000 of tax and fee “leakage” which would equate to a little over 2% of the portfolio value. Over a six-year period with compounding and the assumptions outlined above, this would equate to a difference of around $1,000,000 in the value of the portfolio.

One other quick but very important point where we are different from our competition is our approach to tax planning and tax sensitivity related to tax loss harvesting. As a CPA with tax clients who are not SHWM clients, I have been in a position on far too many occasions to encourage outside advisors to trigger losses during periods of market weakness and book tax losses whether they can be used currently or be carried forward to future years on behalf of their investment clients (and our tax clients). I would estimate that 80-90% of the time, the advisors respond with “we’ll review this in December.” Often, the opportunities to harvest the losses disappear by year-end as the markets recover. A missed opportunity for their investment clients and an unnecessary tax burden for our tax clients.

Alternatively, they may respond that they don’t want to sell and sit in cash for 30 days to avoid the wash-sale rules (this law disallows a tax loss if you sell a position at a loss and buy in back within 30 days). I then explain how they can keep the client invested and avoid the wash-sale rule.

Markets can be very volatile at times and clients may have different tax lots in their portfolios. We constantly monitor for opportunities to book tax losses that can be used to offset future gains. This enables us to rebalance portfolios or raise cash in the future while deferring or at least minimizing taxes.

Summary

The above examples are just a few of the many ways we continuously work to minimize client’s taxes. We do not expect everyone to understand all the machinations of how taxes and investments are interrelated. However, we do know that the investment industry is so focused on performance – but performance analyzed pre-tax versus after-tax. What really counts is after-tax performance. We are keenly aware of what matters the most and remained focused helping our clients achieve their goals. Our association with Smith and Howard, a nationally recognized accounting and tax firm, provides us with a depth and breadth of tax knowledge unparalleled by our competition.

I invite you to contact us to learn more about our approach (404-874-6244).

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.