Identifying Real Spending: It’s All in the Details

by: Smith and Howard Wealth Management

With so many investment and financial planning options available to individuals, it is important to understand what’s important when deciding on a provider. When people ask us why they should select Smith and Howard Wealth Management (SHWM) instead of any others, the basic answer is simple: we focus on the details that matter.

Many firms provide the same services we provide, but I have come to realize that most firms do not place the same amount of emphasis or thought into their approach. This lack of analysis or forethought can produce negative financial implications in the present or many years down the road. On the flip side, close attention to these details provides the best opportunity for realization of your pre- and post-retirement goals. It just takes focus.

We are a team of experts that serve as the Chief Financial Officer (CFO) to our client’s family. As the family CFO, we are focused on preparing and analyzing the family’s financial picture – and making recommendations – the same way a CFO of a business would. This involves preparing and analyzing the following:

Because the end goal for most of our clients is a comfortable retirement, it is important that we have a reliable picture of annual spending as we prepare a retirement projection. Why is pre-retirement spending so important to post-retirement spending? We explain that below.

The Present: How much do you (really) spend?

We start all retirement planning projects, regardless of whether the client is still working or already retired, by focusing on annual spending. Our goal is to determine either:

We recently met with a couple who was looking to retire in 10 to 15 years. During our initial conversation, we asked them how much they spend during a year. After a little thought, they said $200,000 a year would be a good estimate of their annual expenses, excluding income taxes. To ensure we were working with a good estimate, we performed additional analysis to determine the couple’s true annual spending. We reviewed their tax returns to determine their cash inflows as well as their annual income and payroll taxes expenses. We then confirmed their annual savings by reviewing W-2s and investment statements. Additionally, we reviewed their mortgage amortization.

Here is a summary of the information we gathered based on our review.

| Wages | $500,000 |

| Taxes | (125,000) |

| Savings and Principal amortization | (75,000) |

| $300,000 | |

| *all interest and dividends are being reinvested / saved | |

Annual spending calculation

From the information we gathered, you see that wages, minus taxes, minus savings and principal amortization, equals $300,000 of annual spending versus $200,000 as estimated by prospect.

What are the implications of planning using an incorrect annual spending figure?

Annual spending is the starting point to determine how much an individual or family needs to accumulate to fund their lifestyle during retirement. Example of using an incorrect assumption:

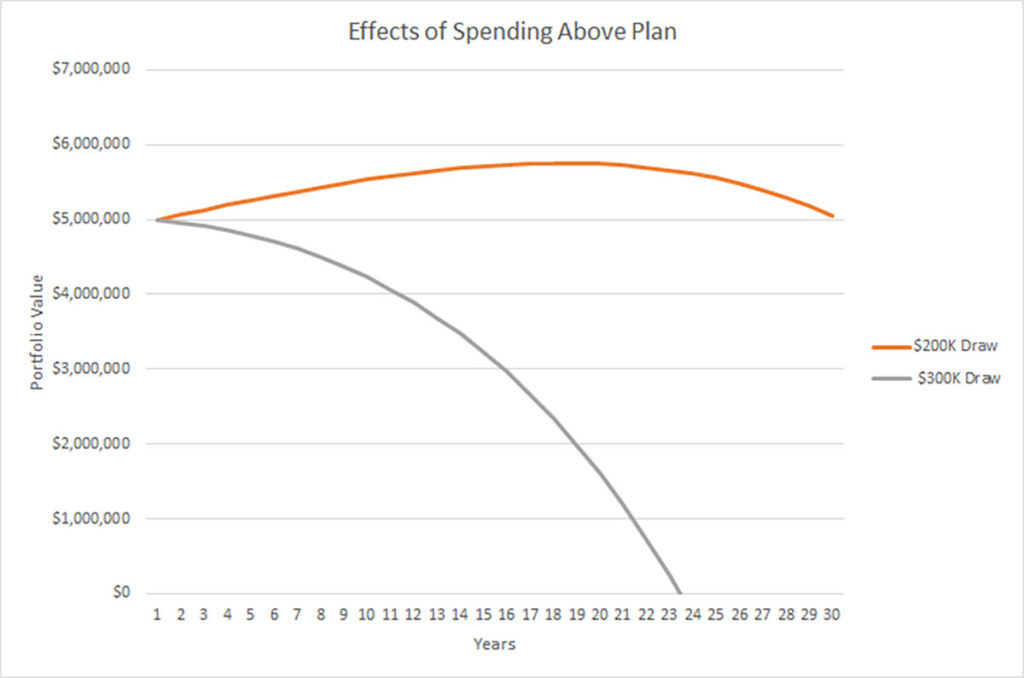

Assume a 4% annual withdrawal rate from the individual’s portfolio coupled with basic underlying investment assumptions (long-term investment returns 7.5%, inflation 2.5%, fees 1.0%); this equals a real rate of return of 4%. The incorrect annual spending estimated provided by the client of $200,000 divided by 4% equals a required portfolio of $5,000,000. A correct spending estimate of $300,000 using the same assumptions equals a required portfolio of $7,500,000 portfolio: a significant difference of 33%.

What does this mean in real terms? Worst case, this couple could retire and continue to spend more than their investments can sustain and they will ultimately have to make drastic lifestyle changes during retirement.

Aren’t all investment professionals focused on this important detail?

While it may now seem obvious that annual spending is a critical piece of the investment and retirement planning responsibilities of advisors, we know that very few advisors approach it in this way and even fewer with this level of detail. For example, when we were hiring a new financial planner in 2018, we asked candidates how they had determined clients’ annual spending in their previous planning firms.

The answers included:

For both the client and the planning, these are not sufficient to accurately gather this important information. We answered the spending option earlier. For budgets, our experience shows that very few people take into account all of the actual spending that should go into an accurate budget; it is difficult, time-consuming and emotionally unpleasant to see just how many ways personal dollars are spent when it is needed for retirement planning. Asking clients to use online monitoring tools sounds like a great option, but it takes months or years to get an accurate picture of spending, plus it takes significant time for the client to create and input all of the data, link investment accounts, credits cards and bank accounts – each important for accurate spending information.

Our goal is to make it as easy and streamlined as possible so that we can get down to the business of actually helping you plan for that comfortable retirement.

Determining what a family spends both before retirement and during retirement is by far the most important input into any financial plan, based on my experience. Accordingly, we follow a proven detailed process to figure out what a person spends, which mirrors the way a CFO figures out the annual cash flow of a business. Just like a CFO we continue to monitor and analyze the family’s situation every year. We do this to help keep them on track and spot trends. This requires additional work but is part of consistent and repeatable process and it’s this level of analysis that helps differentiate SHWM.

Please call (404-874-6244) or email me with any questions about our approach to analyzing spending in our financial planning process.

Tim Agnew, Managing Director

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.