Longfellow famously said, “Into each life some rain must fall.” In the world of investing, we modify that to, “Into each portfolio some loss must occur.” On the bright side, there is sometimes a way to create a ray of sunshine from the downside of a loss.

Clients of Smith and Howard Wealth Management (S+HWM) benefit from our association with Smith and Howard, a nationally recognized accounting firm. This association, with its access to the entire tax group of Smith and Howard, coupled with my 25-plus years of tax experience, mean that we maintain an expert, tax-aware approach to our clients’ investments. Among the strategies resulting from this expertise is the very specialized and disciplined approach to tax-loss harvesting.

How Realizing a Loss Today Can Reduce Your Future Taxes

Tax-loss harvesting, if done properly, allows an investor to realize an investment loss for tax purposes without compromising or cashing out of the market. This can be achieved by selling any security that has experienced a loss and at the same time buying a similar, but not quite identical (to meet IRS rules) security to maintain market exposure.

For example, a hypothetical client named Stewart brings cash he wants S+HWM to help him invest. Taking into consideration his financial goals and investment risk-tolerance level, we may advise and recommend 10 different investments. Several months in, two of the strategies have unrealized losses due to normal market volatility. This is not entirely unexpected, since in any well-diversified portfolio, there will be both winners and losers (that in different market conditions will be winners).

The winners in Stewart’s portfolio now represent a future tax liability, but by harvesting losses on the two strategies that are below cost, we can reduce or eliminate his tax liability.

Strategies for Maximizing Gains

Our purpose, however, is not just to target a loss. It’s crucial that the proceeds from the sale of the security below cost is reinvested immediately in order to maintain the optimal exposure to the market. We maintain a list of comparable investments in order to make this happen – and happen quickly.

For example, by liquidating your U.S. small-cap holding, we can buy another similar U.S. small-cap holding so you’re still invested in that sector of the market.

Year-Round Harvesting

At S+HWM, we proactively monitor client portfolios for tax-loss harvesting opportunities all year, not just at year-end when others are just starting to think about taxes. The commitment and expertise in doing this throughout the year can potentially make a tremendous difference in portfolios and in tax liabilities. It is especially important when markets are volatile.

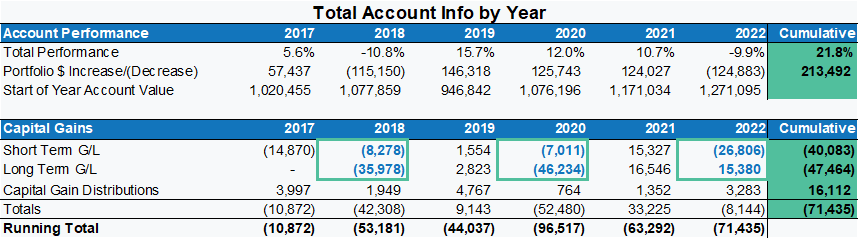

For example, let’s look at two examples of actual tax-loss harvesting we undertook for a client in February 2018 and March 2020 during periods of market weakness. Various portfolio positions were down during those months, not because they were bad investments, but due to normal market volatility. By selling positions that were at a loss and replacing those positions with substitute funds with the same objective that we had already vetted, we were able to both lock in tax losses and maintain portfolio positioning. By remaining invested clients were well-positioned when markets recovered by the end of the year. They enjoyed gains that remained unrealized at year’s end and therefore not yet taxed. In both instances, with markets rebounding quickly and meaningfully anyone waiting until November or December to tax-loss harvest completely missed the opportunity to reduce or eliminate future tax liabilities. Looking at this particular account we can see that the client has enjoyed a gain of close to $340,000 or 35.1% over five years yet has not had to pay taxes on any capital gains realized or distributed. In fact, we have been able to maintain a tax loss carry forward for future years.

Estimating the Value Add

The tax savings and the earnings on those savings for this client we estimate totaled $14,000 or about 1.4% of the beginning $1,000,000 balance over five years. That amounts to an annual increase in returns of roughly 0.25% to 0.30%. The account also has unused tax loss carry forwards of just over $63,000 that have future value. If we translate that $63,000 into tax savings at the long-term capital gains rate of 23.8% that is roughly another $15,000 of benefit to the client, or an added 0.25% to 0.30% per year. The combined, estimated annual percentage benefit to client equates to roughly +0.50% to +0.60%.

Why Smith + Howard Wealth Management Differs from Other Firms

Unlike S+HWM, most advisors miss the opportunity to capture one of the biggest (and easiest) value adds available to investors – tax loss harvesting. The reasons vary, but include:

- Firms are too busy trying to generate new business

- Firms only look for tax-loss harvesting opportunities at the end of the year

- Firms are using managed portfolio programs that don’t allow or restrict tax-loss harvesting

- Tax-loss harvesting would negatively impact their portfolio composite return data they report

- Advisors are managing too many relationships which impacts their ability to act quickly and monitor opportunities

Beware the Wash Sale Rule

The IRS’s wash sale rule says that if you sell something at a loss, you can’t re-purchase it for 30 days. Some people make the costly mistake of using the proceeds to buy an entirely different investment that may perform very differently that they hold for 30 days before selling it – at a gain or a loss – and getting back into their original investment. The problem with this approach is if you’ve had a gain on your temporary investment, you’ve just triggered a short-term gain, which is more expensive from a tax perspective than a long-term gain. For our typical affluent client, it’s twice as expensive.

What’s more, when you go back to your original investment, if its value has increased, you’re buying it back at a higher price. When we reinvest our clients’ proceeds from a tax loss harvest, we put them into an investment that we’re completely comfortable holding for the long-term. If we go back to the original investment, it’s typically because we have another opportunity to tax loss harvest.

Following a Plan, Not Instinct

While it sometimes makes sense to hold an investment that is below one’s cost basis, assuming portfolio positioning can be maintained it generally makes sense to take advantage of an opportunity to create future tax savings. One byproduct of tax loss harvesting is that it may result in a portfolio with positions that have a low-cost basis.

Tax loss harvesting is a complex process that requires a high level of combined expertise in taxes and investments and is a key component of the services we provide S+HWM clients. We approach it methodically and consistently with each client’s financial situation and goals in mind.

Your Family’s CFO

Whether it’s advice on the best way to optimize the performance of your investment portfolio or how to trim your tax bill, Smith and Howard Wealth Management serves as your family’s CFO. We strive to support you in making the best possible financial decisions to serve your family’s particular situation and goals and bring you financial peace of mind.

If you have any questions about tax-loss harvesting – or any other aspect of your family’s financial life, please contact me, Tim Agnew, via email.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Back to Insights

Back to Insights