How to Maximize Charitable Giving Under the Tax Cut and Jobs Act

by: Smith and Howard Wealth Management

On December 20, 2017, Congress passed the Tax Cuts and Jobs Act (TCJA), the most comprehensive tax legislation in decades. Since passage of the legislation, we are often asked by clients, “How does this affect me?”. As with most things in financial planning, the answer is often, “It depends.”

Most taxpayers are understandably eager to claim any and all tax deductions. According to the Tax Foundation and the most recently published data from the IRS, 30.1% of households in 2013 chose to itemize their deductions. However, some experts are suggesting that as many as a whopping 90% of households will no longer itemize deductions at all because of the TCJA. We are working with clients to maximize their tax benefits based on the new legislation. First, let’s establish the facts as we know them.

Clearing the Hurdle of The Standard Deduction

The TCJA eliminated personal exemptions, but nearly doubled the standard deduction. In 2017, the standard deduction was $6,350 per person or $12,700 per married couple. For 2018-2025, the standard deduction was raised to $12,000 per person or $24,000 per married couple. This is a significant difference that tax planners will have to consider when determining whether to take the standard deduction, or itemize deductions on Schedule A. The deductions allowed on Schedule A of your income tax return are designed to encourage certain behaviors (e.g. charitable giving).

The TCJA also reduced or eliminated other deductions on Schedule A. For instance, starting in 2018, the maximum allowed deduction for all state and local taxes paid is capped at $10,000. Furthermore, mortgage interest is deductible only on the first $750,000 of acquisition indebtedness (only for new mortgages) and home equity indebted interest was removed entirely. This means that a Home Equity Line of Credit (HELOC) may no longer be deductible. Finally, an entire category known as “miscellaneous itemized deductions subject to the 2%-of-Adjusted Gross Income (AGI) floor under IRC Section 67” was eliminated.

The significance of these eliminations and changes will be felt by taxpayers until the sunset or expiration of the TCJA in 2025. Congress does have the option to extend the provisions beyond 2025. Until then, $24,000 of itemized deductions is a large hurdle for most American households to surpass making the standard deduction the more likely default without careful planning. Here are a few strategies that we’re implementing with clients.

The Era of Deduction Lumping

From a tax perspective, taxpayers have a lot of control over the timing of deductions for charitable giving. They have the ability to choose the amount that they donate, plus the cap for deductibility is much higher under the TCJA. Taxpayers are capped at a generous 60% of AGI for cash donations to public charities and 30% of AGI for donating appreciated securities to a public charity.

It’s also possible to further control the timing of charitable deductions by “Deduction Lumping” within vehicles such as a Donor-Advised Fund. “Deduction Lumping” means that individuals attempt to realize as many deductions as possible in a single year to surpass the now higher standard deduction levels. A Donor Advised Fund is a philanthropic vehicle individuals and families can establish. A Donor Advised Fund will allow the taxpayer to gift appreciated securities now and decide how the donation is allocated later.

For Example: Steve and Cindy are retired and have $120,000 Adjusted Gross Income from Social Security, IRA distributions, and Cindy’s pension. They pay the high price of $10,000 in property tax for their home in Fulton County. They’re lucky to have no debt and no special medical expenses this year.

Given Steve and Cindy’s situation, they’d need to make $14,000 of charitable contributions this year before any benefit is seen in excess of the Standard deduction. Steve and Cindy like to give $10,000 annually to various charities that are close to their heart. This is where a Donor Advised Fund can come into play. If Steve and Cindy choose to gift $25,000 in appreciated stock to a donor advised fund today, they can take more of the deduction now. A donor advised fund is assumed to be a completed gift for income tax purposes. This means that they would take the tax deduction during the year the securities are transferred. However, Steve and Cindy can direct which qualified charity receives the funds and when the charity receives the funds. Steve and Cindy will also avoid paying capital gains tax if they were to sell the asset.

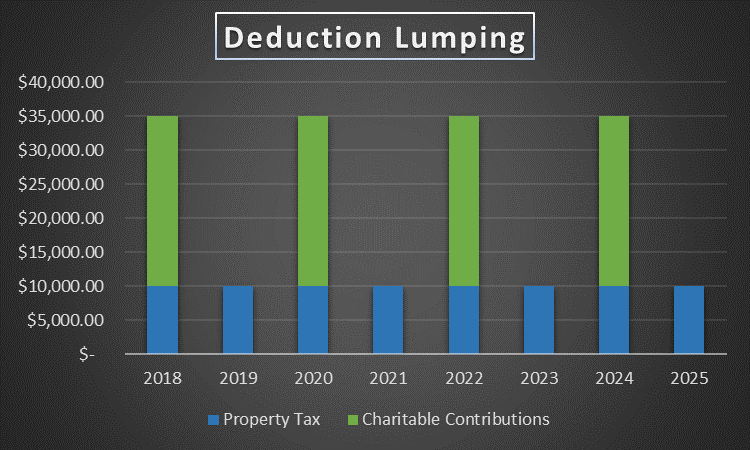

The chart below shows Steve and Cindy deduction lumping every other year, while still meeting their annual charitable giving commitments. In the years where they don’t transfer appreciated securities to their donor advised fund, they will still enjoy the $24,000 standard deduction for a married couple filing jointly.

The tax planning benefit for Steve and Cindy is that by lumping charitable contributions together, donations that would otherwise have fallen below the itemized deduction threshold are at least now partially deductible.

Charitable Planning for Age 70 and Beyond

Taxpayers report their charitable contributions given directly to a charity as a “below-the-line” itemized deduction, which means that this deduction is only valuable to those that itemize deductions in the first place. Because of this, many of our clients that are charitably inclined are looking for alternatives to passing the standard deduction threshold. Luckily for those over age 70, there is a way to meet their charitable goals in a tax efficient manner.

When you turn 70 ½, you’re typically required to take a minimum distribution from your IRA or 401(k). This is often referred to as a required minimum distribution (RMD). The RMD that is taken from the IRA is taxed at ordinary income rates. This can often be a financial burden to retirees, but there are ways to minimize the tax due.

There is an alternative called a Qualified Charitable Distribution (QCD). The QCD can be an effective way to leverage tax benefits of charitable giving. Those over age 70 ½ who have an IRA or an inherited IRA, have the ability to take advantage of this strategy.

For Example: Steve and Cindy are now age 72 as of the beginning of 2018. They collectively have $40,000 that’s required to be distributed from their IRAs. They still want to gift $10,000 annually to various qualified charities and receive the maximum benefit. In addition, they’d also like to give a $30,000 donation to Cindy’s alma mater this year, since her schooling was instrumental in her success. Steve and Cindy decided to meet their charitable obligations by writing the various qualified charities a check from the IRA.

There may be additional benefits to Steve and Cindy above and beyond the tax efficient way to gift to charity when using a QCD. Their Medicare Part B and D premiums are determined by the taxpayers’ Modified Adjusted Gross Income. By removing this income from their “above the line” modified adjusted gross income, they may be able to lower their premiums. In addition, tax on Social Security income is determined by provisional income. Some individuals may be able to lower this, as well. Both of these numbers would be effectively lowered by doing a QCD from their IRAs. Given that the standard deduction has effectively been doubled, this strategy works well for Steve and Cindy. The QCD may continue to be a more effective way to contribute to charity until the TCJA sunsets and Congress determines whether to extend it. This would need to occur by 2025.

Every situation is different, but we can guide you in making decisions that best suit your situation. Feel free to call or email Michael Mueller at 404-874-6244 to discuss any questions you have about charitable giving under the Tax Cuts and Jobs Act.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.