Evaluating the Economic Impact of the Coronavirus

by: Smith and Howard Wealth Management

The coronavirus is severely impacting China’s economy and recent data suggests that this is spilling over to other economies, particularly in Emerging Asia. As of February 23rd, China’s National Health Commission reported over 76,000 confirmed cases and over 2,500 deaths resulting from the Covid-19 virus. With Chinese factories still closed for business, the disruption to supply chains will continue to intensify. Certain sectors such as the auto, textile/apparel, and electronics industries will be impacted along with countries in Emerging Asia who rely on China for inputs and tourism spending. The stock market reaction has been relatively muted until this week with a sharp increase in the number of cases in Italy, indicating the virus is continuing to spread outside of China. U. S. markets on Monday (2/24/20) lost about 3% and gave up year-to-date gains. Emerging Market stocks lost about 3% on Monday and are down 5% year to date.

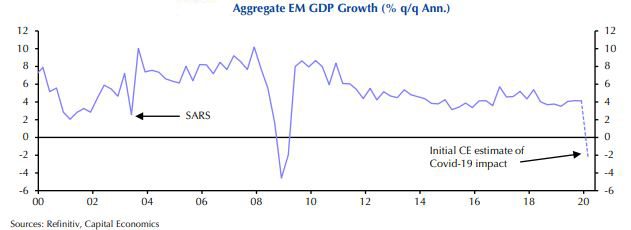

As shown in the graph below, the Emerging Market region is expected to report a quarterly decline in economic growth of about 2% for the 1st quarter of 2020. In aggregate, manufacturing sectors in advanced economies have limited supply chain exposure to China and will likely see less of an impact.

China is the world’s manufacturing powerhouse and a major part of the global supply chain for the auto industry, textiles/apparel, and electronic devices. Hyundai was the first major auto manufacturer to announce plant closings outside of China in South Korea due to a lack of parts, followed by Nissan in Japan. In Vietnam and Cambodia, the textiles and apparel industries are heavily reliant on inputs from China and these represent large industries in these countries.

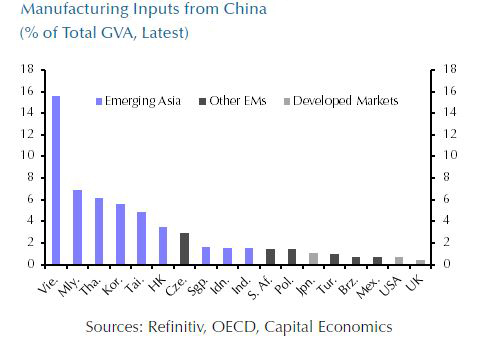

East Asian countries such as Vietnam, Malaysia, Thailand, South Korea, and Taiwan are most at risk to coronavirus-related disruption to manufacturing supply chains. As shown in the chart below (Manufacturing Inputs from China), Vietnam has the highest exposure, with component parts sourced from China representing 16% of the size of its economy (as measured by Gross Value Added, an alternate measure of GDP). On the other end of the chart, the U.S. receives about 1% of its manufacturing inputs from China.

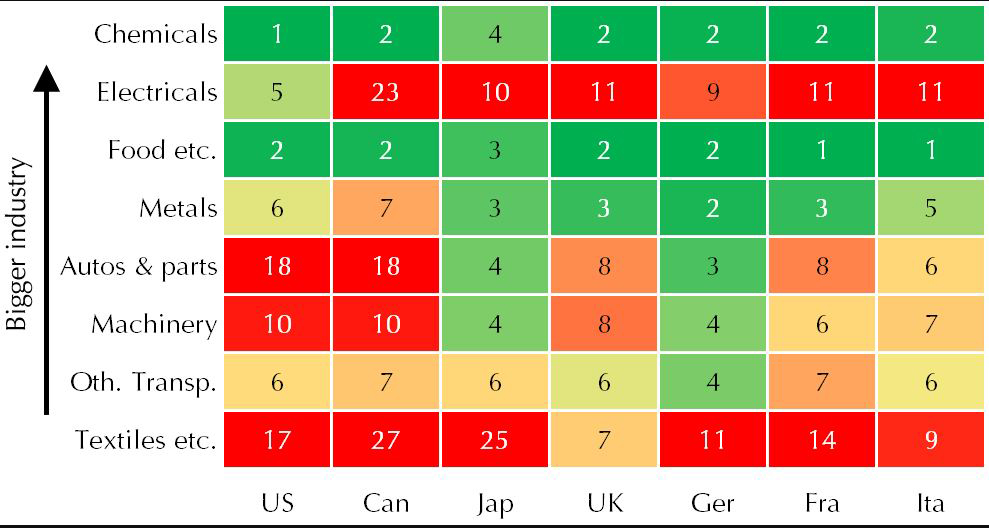

Manufacturing sectors in advanced economies have limited supply chain exposure to China which partly reflects the fact the manufacturing accounts for a small share of the economy (about 11% in the U.S.). However, some individual manufacturing industries in the G7(1) do have substantial supply chain exposure as shown in the chart below. While Chinese inputs for textiles firms are large relative to the sector’s Gross Value Added, the industry only makes up a tiny share of overall manufacturing. More concerning is the widespread reliance of electronic manufacturers within the G7 countries as this is the second largest manufacturing industry.

Many firms should soon be able to source inputs from elsewhere, just as they managed to shift supply chains during the U.S.-China trade war. In the electronic device industry, Apple is reporting a disruption in production due to its manufacturing plant located in China. Apple announced last week the company is shifting some iPad and Apple Watch production from China to Taiwan. In addition, second quarter revenue guidance will likely miss due to lower sales in China and decrease in production.

In addition to manufacturing, tourism and retail spending in the region are being hit hard as a result of travel restrictions and a decline in consumer activity. International visitor arrivals at major airports in the region such as Bangkok, Thailand and Phuket, Thailand have fallen dramatically. Tourism spending accounts for 18% of total GDP in Cambodia and 12% of GDP in Thailand and Hong Kong. Indicators from China show that households are limiting non-essential trips and spending. When compared to the SARs outbreak in 2002, that health scare created pent up demand which then rebounded quickly once the virus was contained. However, the SARs epidemic occurred during a time in which China was a much smaller player on the world stage. The mobility of populations has increased dramatically changing the potential for viral contagion and deepening the economic impact, especially given the rise in global tourism since the early 2000s.

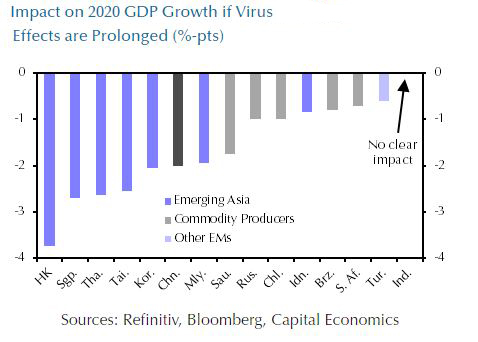

If the virus continues to spread or supply chain disruptions become more severe, there would be a much sharper slowdown in the rest of the emerging world. Chart 4 provides an indication of possible impact to GDP growth if the virus effects are prolonged. As you can see in this scenario, if China reports a negative growth rate for the entire year of 2%, certain East Asian countries, including Hong Kong, Singapore and Thailand, would be hit the hardest with an even larger decline in growth than China. Commodity producing countries like Saudi Arabia, Russia, and Brazil could also suffer if there was a sharp decline in the demand for energy.

A likely scenario as of now is that China and the Emerging Market region will report negative growth for the first quarter of 2020 given the number of plant closings and decline in retail spending. A temporary disruption should have limited macroeconomic impact to developed markets while the impact to specific industries and individual firms could be significant. If the virus is contained in the next few months, most of the lost output could be recovered later in the year. We will continue to monitor these developments and the possible economic impact to global growth.

As always please contact us (404-874-6244) with any comments or questions. Thank you for your continued confidence in Smith and Howard Wealth Management.

(1) G7 countries include Canada, France, Germany, Italy, Japan, the United Kingdom and the United States.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.