Commentary on March 9 Market Selloff

by: Smith and Howard Wealth Management

Vanguard wrote in its 2020 outlook: “investors should expect periodic bouts of volatility in the financial markets, given heightened policy uncertainties, late-cycle risks, and stretched valuations. Our near-term outlook for global equity markets remains guarded and the chance of a large drawdown for equities and other high-beta assets remain elevated and significantly higher than it would be in a normal market environment.” It is impossible to know how investors might have reacted to the Coronavirus under other circumstances, and now to the effect of oil prices on the market, but to Vanguard’s point, this hasn’t been a normal market environment for a while and that made the system vulnerable to an adverse shock.

It seems hard to imagine, but it was only a few short weeks ago that the S&P 500 Index closed at a new all-time high. As most investors are painfully aware, equity markets have traded off significantly since that record close due primarily to the Coronavirus and its potential health and economic consequences. As bad as things had been the prior two weeks, they reached a different level of magnitude yesterday as the S&P 500 dropped -7.6% on the day. That left the index nearly 19% below its recently reached closing high. Interestingly, the selloff yesterday occurred exactly 11 years to the day that equity markets bottomed during the financial crisis (March 9th, 2009).

The What and Why of Yesterday’s Selloff

While things have been volatile and negative for the last two weeks, the intensity of the selloff yesterday understandably raised questions about what changed or why now. The short answer is that in addition to the Coronavirus, another trouble spot has emerged.

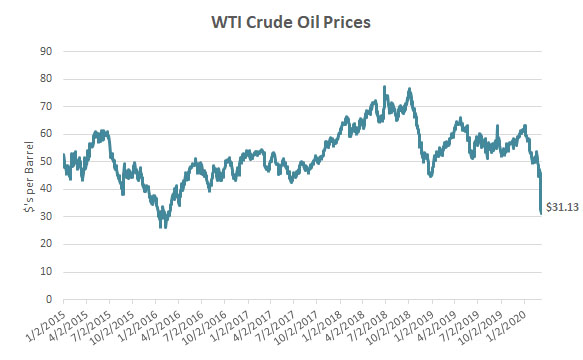

Energy markets, specifically the price of oil, have been hit hard the last two trading days. OPEC (Organization of the Petroleum Exporting Countries) and Russia were widely expected last week to extend or even increase oil production cuts that were expected to help support the price of oil. Much to the surprise of the market, however, they were unable to reach that agreement. Making matters even worse, Saudi Arabia announced slashed prices in an apparent price war with Russia. As a result, oil has now fallen from the low $60s at the beginning of the year to the low $30s.

A significant portion of that drop occurred yesterday as oil had its largest one-day percentage drop since 1991. Falling oil prices have historically been considered a net positive for consumers and global energy demand, but given the demand related issues caused by the Coronavirus outbreak, that may not be the case in this instance.

Markets hate uncertainty and with the collapse in oil prices joining Coronavirus fears, we are now coping with two very uncertain and difficult-to-model situations.

Navigating Difficult Times

It would never be our intention to skim over the human cost or element of what is occurring, but as a financial advisor our day job means we must also help our clients navigate difficult times. As painful as such periods may be, they also present opportunities.

In addition to staying the course, we want to look for opportunities to tax loss harvest and rebalance where appropriate. In this note our comments have focused primarily on stock markets, but we would be remiss in not mentioning that there are actually areas of the portfolio that are benefiting or profiting during this time. Fixed income, in particular, continues to be a bright spot. In a flight to safety, investors have flocked to high quality bonds, which drives up their prices (and returns). Uncorrelated alternatives, namely trend following managed futures, have also posted positive results during the selloff. As we look to rebalance, we seek to take advantage of the relative strength in those areas.

Silver Lining: Equity Markets Are Cheaper

We certainly don’t believe our crystal ball is any clearer than anyone else’s and would never attempt to “call a bottom”. What the next few days, weeks, or even months hold is impossible to know. What we can say with confidence is that equity markets today are notably cheaper than they were just a few short weeks ago; historically, that has improved future long-term returns for investors willing to look beyond the short term.

Markets are very likely to continue to be volatile, both up and down, but we will do our best to keep you informed on what is happening and what actions we are looking to take in portfolios. Should you have any questions, please don’t hesitate to email or call me (404-874-6244) or any of your team members at Smith and Howard Wealth Management.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.