Commentary – Markets and Oil Prices

by: Smith and Howard Wealth Management

In our market commentary yesterday (March 10, 2020), we noted that one of the reasons the selloff on Monday was so extreme was the sharp and unexpected drop in the price of oil. Many investors, already weary from the ongoing threat of the Coronavirus, threw in the proverbial towel when this second potential pitfall emerged. As the media headlines and our prior note stated, the drop in oil price was the result of an unexpected spat between Russia and Saudi Arabia. While this certainly isn’t the first time the two countries have had a disagreement, investors are understandably questioning why now. What led to this point? It is with those questions in mind that we share some of our thoughts and perspective.

OPEC+: A rift in the alliance

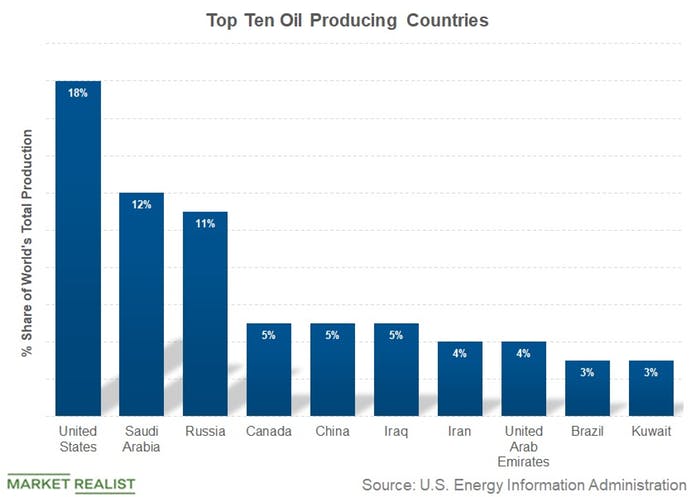

The rift between the two countries emerged late last week during the OPEC+ meetings. For those unfamiliar with “OPEC+” it is an alliance of oil-producing countries that formed during 2016 with the expressed aim of resuscitating oil prices at the time. The alliance brought together the members of OPEC (Organization of the Petroleum Exporting Countries) led by Saudi Arabia and a number of non-OPEC members led by Russia. The group has continued to work together to manage oil production at the country level in an effort to keep per-barrel prices stable and at levels acceptable to its members. It is noteworthy (and a bit of foreshadowing) that despite the United States now being the top oil-producing country in the world, it is not a member of the alliance.

Current agreed-upon production levels by members of the alliance were set to expire at the end of March, so the meeting last week was to set out new production levels that were anticipated to last through the remainder of 2020. Due to lower crude oil demand related to the Coronavirus, OPEC, led by Saudi Arabia, had proposed a 1.5 million barrel per day reduction in oil production. The Saudis were effectively offering to cut their own production by 1 million barrels if Russia was willing to make up the difference (0.5 million barrels per day).

Russia Balks

To everyone’s surprise, Russia would not agree to the production cut. Bloomberg reported that Russia wanted U.S. producers to reduce production, as well. There was speculation that Russia’s stance was in retaliation for the U.S. sanctions placed on Russia related to the construction of a natural gas pipeline (Nord Stream 2). The U.S. may not be a member of the alliance or have a seat at the table, but they were nonetheless the elephant in the room. With Russia unwilling to agree to the original proposal, the Saudis changed tactics and effectively started an oil price war. The Saudi’s response was to offer significant discounts on oil ($6- $8 per barrel) to its customers in Asia, the U.S. and Europe and threaten to increase production.

Rationale for Cut in Production

The impact of the Coronavirus on global oil demand is far from certain, but estimates have ranged from 600,000 to 1,300,000 barrels per day. That is the reason OPEC had proposed the cut of 1.5 million barrels. A cut of that magnitude would have resulted in reducing supply to levels close to the new estimates for global oil demand. For scale or perspective, it is worth noting that global oil demand is normally approximately 100 million barrels per day, so a cut of 1.5 million barrels is equivalent to just 1.5%. Hard to imagine, but the failure to agree upon a cut equal to 1.5% of global demand resulted in oil dropping by 25%, its largest single-day price drop since January 17, 1991 when a U.S.-led coalition launched Operation Desert Storm.

How does this get resolved?

An oil price war is less about who will “win” and more about who will be hurt the most and how quickly it will happen. Russia, Saudi Arabia and the U.S. are the world’s three largest oil-producing countries and lower prices are generally not good for any of them. Saudi Arabian oil wells may be profitable with oil prices in the $30s, but the country itself operates at a fiscal deficit and needs oil prices at $80+ per barrel to balance the budget. The question as it relates to the Saudis is how long they can afford to push prices lower to force the hand of Russia or other parties. The Saudis do have a large cash reserve of $490 billion (per Reuters) which would allow them to operate at a fiscal deficit for some time, but that figure is already down from $714 billion in 2014. Oil in the low $30s would likely reduce that reserve by $50-$100 billion per year meaning they can’t play this game forever. Russia’s reported fiscal breakeven is lower but is still in the low $40s. Determining winners and losers in the U.S. is an even more difficult proposition. Breakeven prices vary significantly by company, method of extraction, location of extraction, and countless other variables.

Market participants view the Saudi’s recent actions to be an effort to force Russia back to the negotiating table. To that end, Russia has already hinted that they may be willing to entertain further discussions as it was reported early on Tuesday that the Russian Energy Minister had called a meeting of Russian oil companies on Wednesday (today) to discuss further cooperation with OPEC. Oil prices received a boost from this news, although there is certainly no assurance that it means Russia is willing to reconsider.

It’s a Matter of Time

Much like the Coronavirus, the primary economic and investment issues relate to how long the event lasts. None of the participants wants to have oil in the $20s or $30s for an extended period of time. That doesn’t, however, mean that a resolution and/or price recovery are around the corner. If or when that happens it would certainly be a boost to broader stock and bond markets that are in dire need of some good news.

Markets are very likely to continue to be volatile, both up and down, but we will keep you informed on what is happening and what actions we are looking to take in portfolios. Should you have any questions in the meantime, please don’t hesitate to email or call me (404-874-6244) or any of your team members at Smith and Howard Wealth Management.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.