A Deeper Dive – Bitcoin and Cryptocurrency

by: Smith and Howard Wealth Management

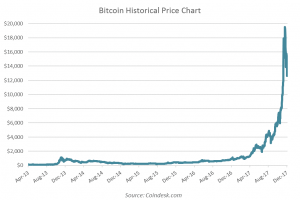

In a Nut Shell: While we don’t believe that Bitcoin or properly structured cryptocurrencies and exchanges are themselves a fraud, there are a number of reasons for investors to be cautious and skeptical. Despite an underlying technology that likely enhances security, the rather clandestine and decentralized nature of cryptocurrencies has attracted hackers and fraudsters, resulting in several instances of stolen coins. The meteoric rise in price over the past few years and especially the latter half of 2017 is also eerily reminiscent of a classic asset bubble. As fiduciaries, we don’t believe that investing in Bitcoin or other cryptocurrencies would constitute a prudent investment given the significant element of speculation and our first priority of preserving client capital.

For insights on our thinking regarding bitcoin and cryptocurrencies, read below.

If the idea of a “cryptocurrency” sounds like something out of a Dan Brown mystery novel, you may be on to something. In the 2003 novel (and 2006 movie starring Tom Hanks) The Da Vinci Code, the main character, Robert Langdon, partners with a young cryptologist, Sophie Neveu, to solve the murder of Sophie’s grandfather. Robert and Sophie race across Europe deciphering codes and hidden messages that eventually lead not to just solving the murder, but also to the mystery behind Mary Magdalene and the Holy Grail.

As a cryptologist, Sophie had been trained in the art of cryptography which has been used for thousands of years to secure or encrypt information and is the key to understanding not just how a cryptocurrency operates, but also its appeal. A cryptocurrency uses the same encryption principles to create lines of digital code with monetary value or more simply, a digital or virtual currency. The most recognized and first cryptocurrency is Bitcoin, established in 2009, but there are more than a thousand other digital currencies (sometimes referred to as Altcoins) and more are launched seemingly daily.

The questions we get from most clients aren’t necessarily about what a bitcoin or cryptocurrency is though. The questions we get are typically more related to the news headlines that they see regarding them. Are they a fraud? Is it a bubble? And of course, should we buy some? None of which have simple, easy, or obvious answers.

Before we get to the questions, the obvious reasons we are getting the questions is the meteoric rise in value (see graph below) that cryptocurrencies have recently experienced. Investors have been attracted for a number of reasons, but initially those reasons related mostly to their interest in a non-fiat currency (a currency not backed by a government) that existed outside of the regulated banking industry. Call them the anti-establishment crowd. While those reasons and people still exist, more recent investor interest and the subsequent price increases are seemingly driven more by speculation and the fear of missing out (or “FOMO” as a former colleague of mine described it).

Are they a fraud? While there is a lot to debate about cryptocurrencies, even the more bearish voices generally agree that the technology (Blockchain) supporting cryptocurrencies is legitimate and even potentially more secure than other modes of electronic currency transfer. The currency and technology platform itself may not be inherently fraudulent, but the sheer volume of capital and the decentralized, clandestine nature of the transactions has of course attracted the attention of criminal hackers, those looking to launder money, and others fraudulently motivated. Just this past quarter, $70 million was stolen from a major cryptocurrency-mining service. Sadly, that is only the fourth largest breach in cryptocurrency history. The largest breach was in February of 2014 when hackers stole approximately $450 million from Mt. Gox, a bitcoin exchange based in Tokyo. Unfortunately for those investors, given the fully decentralized and unregulated nature of cryptocurrencies once those coins have been stolen, they are truly gone. To be fair, the thefts were not the result of the technology or cryptocurrencies themselves, but how or where the investors chose to store them or transact.

That isn’t to say that the investor was at fault, but that more secure methods of storing and transacting exist and would have avoided the issue.

Is it a bubble? This is where the debates get really interesting! Well known investors sit on both sides of this proverbial fence and hold very strong opinions. The venerable Warren Buffett is joined by the likes of J.P. Morgan Chairman, President, and CEO Jamie Dimon and Yale professor and Nobel prize winning economist Robert Shiller as stating that bitcoin and cryptocurrencies are in a bubble or are an outright fraud. Ready to debate fiercely on the topic are billionaire venture capitalists Peter Thiel and Mark Cuban and Microsoft co-founder Bill Gates who see enormous potential and upside.

In the asset management business, making dramatic, polarizing predictions about bubbles can be career making, but are more often career ending. So with self-preservation in mind, we’ll simply say that if forced to choose a side to align with it would be with value investors like Buffett. It isn’t that we aren’t intrigued by or don’t see value in cryptocurrencies, we just can’t define what that value is or should be. As long term investors that is the critical missing piece. In some sense it is similar to a commodity like gold or even art. We can certainly accept that both have value, but neither have a cash flow or a yield making the price essentially a function only of current supply and demand.

For those of us who remember the dotcom bubble all of this starts to sound eerily familiar. After all, investing in something without regard to fundamentals or valuation and hoping to sell it to someone else at a still higher price is the essence of the Greater Fool Theory that ruled the late 90s. That certainly doesn’t mean that cryptocurrencies (or in the case of the dotcom bubble, the internet), were themselves flawed or fraudulent. The price of investment had simply become too detached from the current fundamentals. Some of the similarities are somewhat anecdotal, but the similarities are too obvious to ignore. For example one of the great investor sins of the dotcom bubble was the extensive use of margin or borrowing money to buy more stocks than the investor was able to pay for. Consider that at the end of this past November Google Trends stated that the search term “buy bitcoin on credit card” was reaching historic highs.

While siding more with someone like Buffett does insinuate that we believe cryptocurrencies are in a price bubble, we can still acknowledge that there are also logical reasons for the euphoria. Conceptually, digital currencies have a natural appeal to a large part of the global population interested in avoiding government and bank oversight. As familiarity, comfort, and adoption of cryptocurrencies spreads to the broader global population the demand (and hence prices) for cryptocurrencies will naturally increase. There is somewhat of a self-fulfilling aspect to all of it and we are witnessing the power of that now as the media and price increases push more investors to take notice and participate. Our concern is related to the reasons they are participating and whether or not they really understand what they are buying. How long could the trend continue? It is impossible to know and it would be foolish on our part to even venture a guess.

Should we buy some? You’ve probably already guessed our answer to this question. As fiduciaries for our clients we must follow a prudent investment process meaning that we must always have a reasonable, sound basis for our investment decisions. “FOMO” is clearly not a good reason! Investing simply because the price has been going up (or selling simply because it’s been going down) is speculation, not investment. The first rule of wealth management is preservation of capital. Speculating on new, volatile investments, regardless of how interesting the story is, would clearly violate that rule.

For more insight on cryptocurrencies, please contact Brad Swinsburg 404-874-6244.

Explore more information on the fourth quarter of 2017 by visiting these links:

Market Recap: Fourth Quarter 2017

Market Outlook: Fourth Quarter 2017

On the Horizon: Seven Focus Areas

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.