“Interest rates are to the value of assets what gravity is to matter…they power everything in the economic universe.”

– Warren Buffett

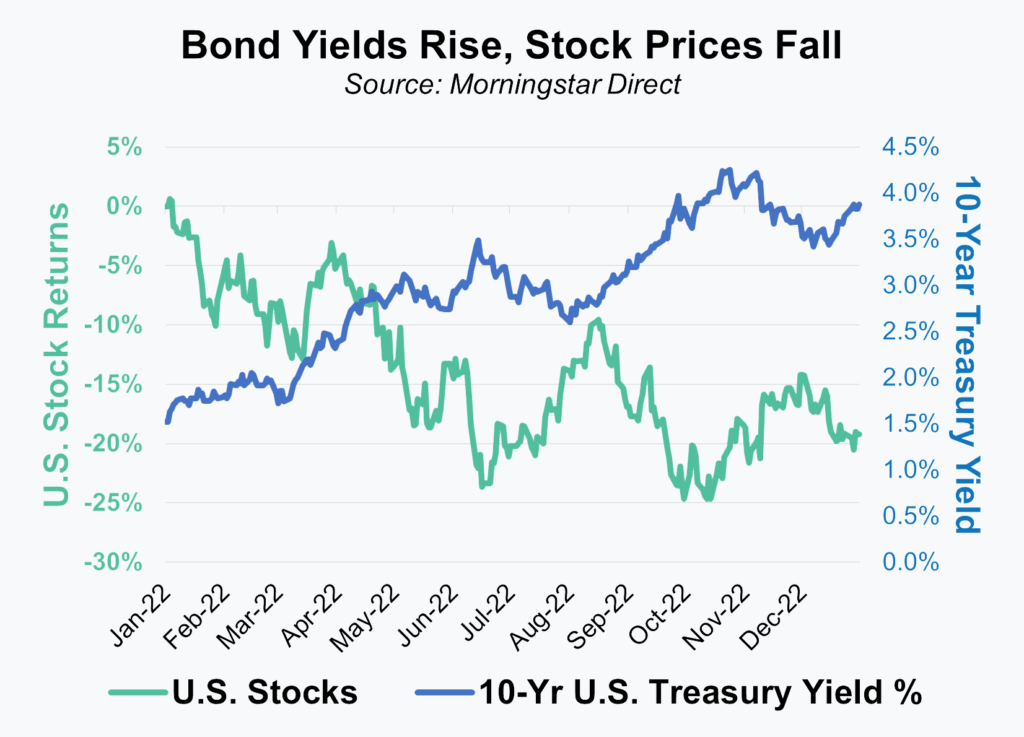

As difficult and frustrating as returns over the past year have been for investors, the explanation for why is relatively simple and straightforward. Higher interest rates, driven by global inflationary pressures, weighed heavily on asset prices for traditional asset classes like bonds, stocks, and real estate. Unlike some selloffs that investors have endured in the past, the most recent retreat in asset prices was surprisingly orderly and even rational. As the graph shows and as Warren Buffett could probably have predicted, as the yield on the 10-Year U.S. Treasury rose, stock prices fell.

Interestingly, movements in interest rates also help explain the modest recovery in asset prices during the fourth quarter. While the Fed has continued to raise short term rates and the yield curve is still materially higher than where it was 12 months ago, intermediate to longer term yields were flat to lower for most of the quarter allowing equities to recover some lost ground.

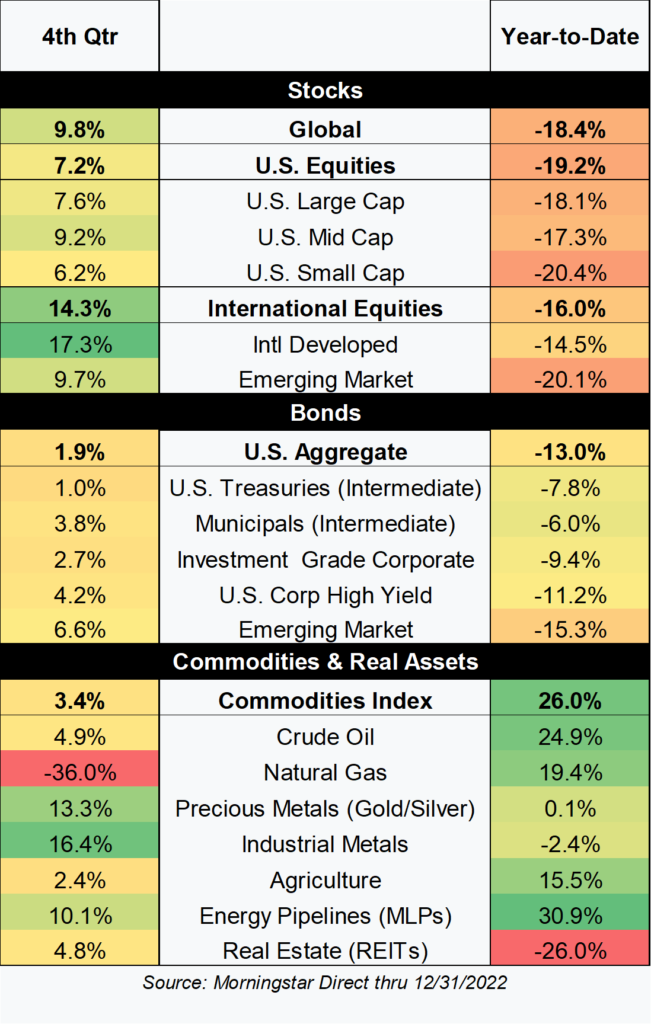

Despite the recent bounce in stocks and bonds, the full year results for markets remained decidedly negative. As mentioned in one of our videos this quarter, U.S. stocks and bonds have only experienced negative calendar year results at the same time on three occasions in the last 96 years and not since 1969. As remarkable as those stats are, they still do a poor job of describing just how difficult a year it was for bond investors. While bonds have had negative calendar year periods before, they’ve typically been in the low single digits and nowhere close to the double-digit loss of -13% experienced in 2022.

If there is a silver lining to the past year, it’s that the retrenchment in asset prices brings with it (and something we’ll discuss more) improved overall market valuations. Despite the negative investment sentiment and the looming fears of a recession, we are excited by the prospects for future returns as broad market valuation levels today are more attractive than they’ve been in probably more than a decade.

Equities

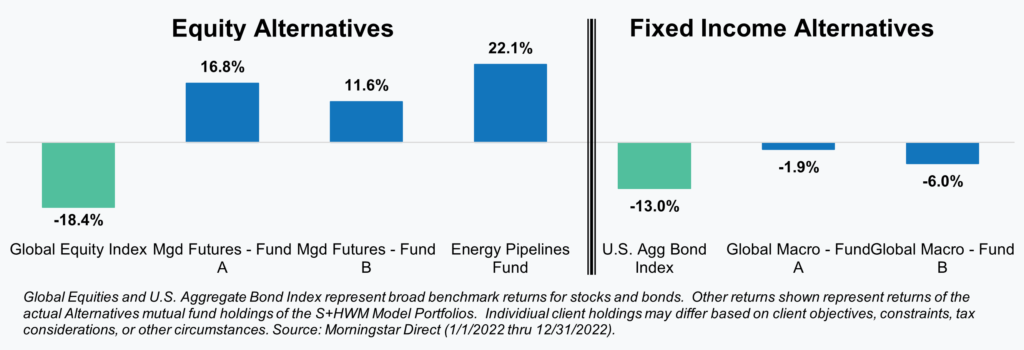

The bounce in equity markets during the recent quarter put a reasonable size dent in year-to-date losses, but unfortunately those losses remained well into double figures for global markets (-18.4%). Various equity markets mostly moved in the same general direction during the year, including this past quarter when returns were positive, but there was a fair bit of dispersion within equities by style and geography – meaning that some markets did better than others.

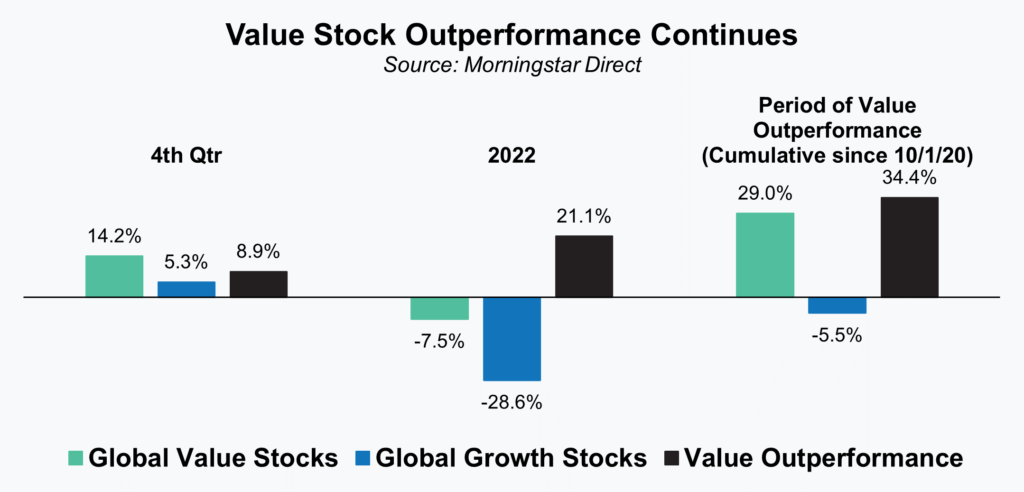

For the fourth quarter and the full year, value stocks meaningfully outperformed growth stocks, regardless of the size of the company or the geography. The trend of better performance from value stocks now dates back to late 2020 and has persisted through both up and down markets. Given our overweight to value stocks the last few years this has been a pleasant development and one that has helped aid performance tremendously. It is fair to begin to wonder how much longer this trend and level of outperformance may persist, but valuation differentials still favor value stocks over growth stocks, and we will continue let those metrics be our guide.

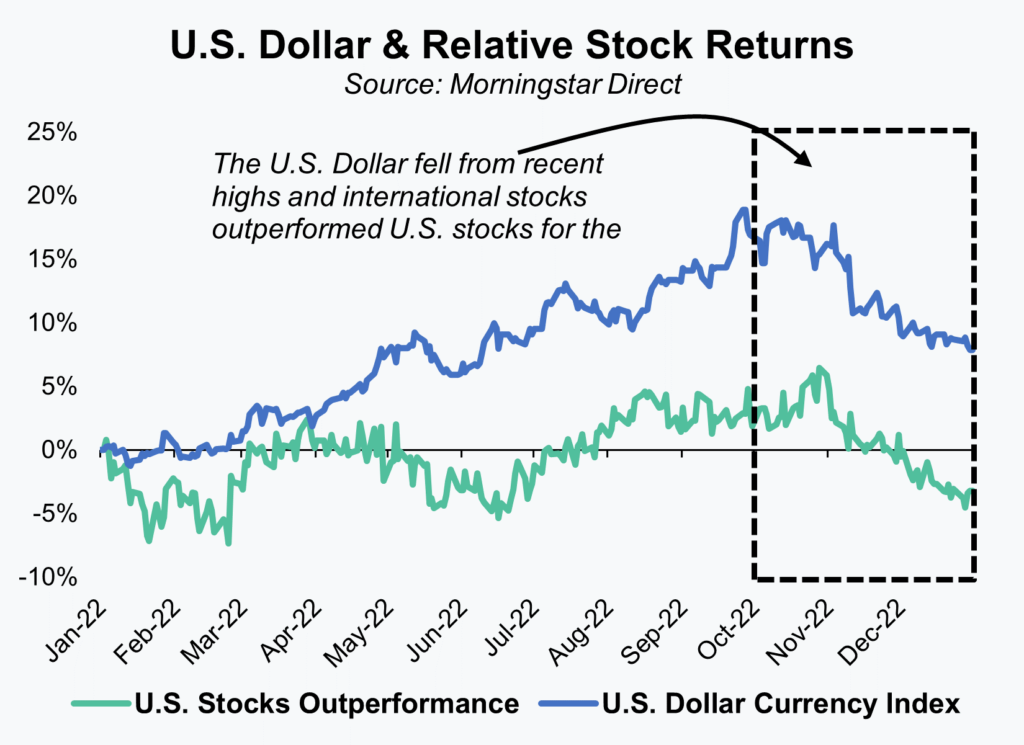

The other market dynamic that is worth noting (and that will likely surprise investors) is the recent shift in performance that favors international stocks relative to U.S. stocks. U.S. markets have enjoyed a prolonged period of outperformance compared to their international counterparts, but that was not the case over the past quarter (and as a result for 2022). A likely driver of the recent shift in relative performance may be the recent performance of the U.S. Dollar (relative to other major currencies). After a very strong period of returns for the U.S. Dollar (USD) earlier in the year, the USD shifted course and dropped 7.7% during the fourth quarter. That closely matches the 7.1% outperformance of international stocks (+14.3%) when compared to U.S. markets (+7.2%%).

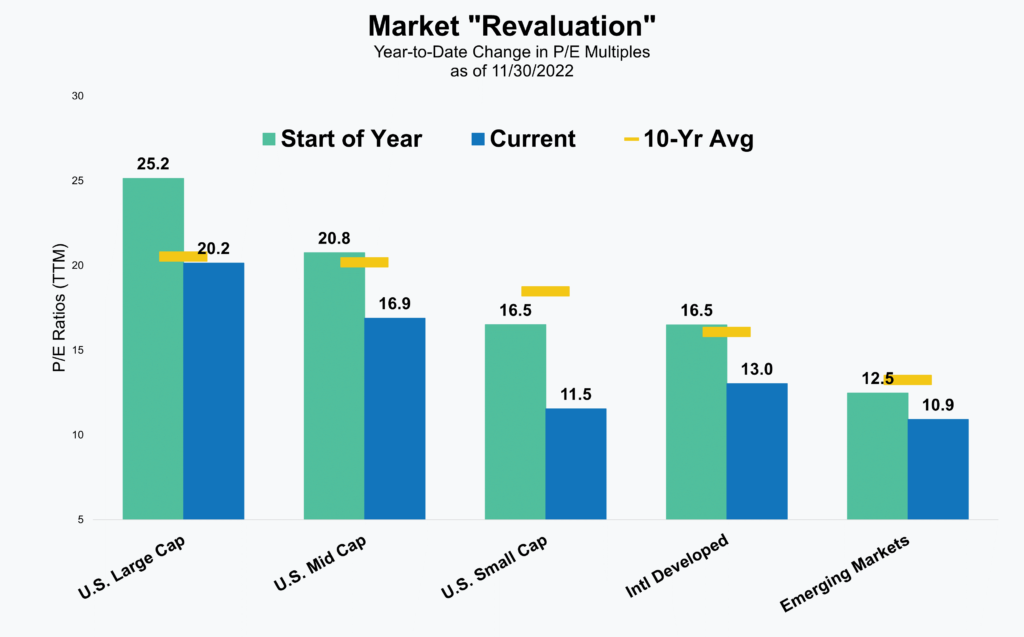

As we’ve reiterated on numerous occasions, we do believe that the recent downturn for stocks has a silver lining in that valuations for stocks are now fair to attractive, depending on the market. As this graph shows the multiple of trailing 12-month earnings that investors are willing to pay for stocks has dropped considerably over the last year (mint green bar compared to blue bar) for major market segments. Perhaps more importantly, for all but U.S. Large Cap stocks, the current multiple is well below the level that has been the norm for the past 10 years (the yellow line). As a firm that believes valuations are the best indicator of long-term returns, this is a positive.

When thinking about future return prospects, we know it can be difficult to look past near-term headwinds for markets, especially after the past year. To that sentiment we want to remind investors of two things. First, there will always be something for investors to be worried about. Today that might include recession fears, the situation in Ukraine, and China’s attempts at reopening their economy. As those fears hopefully recede, new ones will pop-up to replace them, so anyone waiting for the market to have nothing to worry about will likely be waiting indefinitely. Second, some of the best periods in history to put capital to work is when things “feel” the worst. Market and investor sentiment tends to be a contrarian indicator meaning that the worse we feel about the economy and the investing environment the better the opportunity (and vice versa).

Fixed Income

Fixed income investing typically takes a backseat to equities in the minds of investors and in determining overall portfolio performance. That wasn’t necessarily the case during 2022 as fixed income markets and investors experienced something they’ve never experienced before in any calendar year period – losses that reached well into double digits (-13%). That experience has naturally led to a lot of questions, so we thought we’d provide our thoughts on three common questions we’ve heard from investors that relate to fixed income.

Why own bonds at all while the Fed is still raising rates? We understand the temptation to want to wait until the Fed is done raising rates to invest in bonds. It’s also the fixed income equivalent of trying to time the market. We’ll never be a proponent of trying to time markets and we don’t have to look any further back than this past quarter to see that bonds can do well even during periods in which the Fed is still raising rates. Markets are anticipatory which means that bond prices already reflect additional rate hikes by the Fed in 2023. As a result, rate hikes in the coming months don’t necessarily mean that bonds can’t or won’t do well.

If I can get a higher yield by buying a U.S. Treasury Bond that matures in one or two years as compared 10 years, why would anyone buy the one maturing in 10 years? This is probably the question we get the most and it’s a good one. Despite the lower yield of a 10-year U.S. Treasury, there are still good reasons to own it, particularly within a diversified portfolio. First, the shorter maturity bonds are only locking that yield or return in for a short period of time. After they mature you are subject to whatever the current rates are at that time. Buying the longer maturity 10-year bond locks that yield or expected return in for longer before an investor is again subject to what is referred to as reinvestment rate risk.

Additionally, owning the 10-year bond can also provide some immediate upside for an investor in the event that rates move lower. Bond prices move opposite of bond yields and the longer the maturity of that bond the more sensitive it is to those movements. That math worked against longer maturity bonds for much of this year, but should rates drop (like they did for part of the 4th quarter) we’d see the gains in those bonds outstrip the smaller returns in shorter dated bonds. That is an especially important consideration for investors that have a diversified portfolio. That may allow bonds to once again act as more of a ballast or diversifier in the event that we enter into a recession and the Fed actually has to backtrack and start reversing some of their rate hikes.

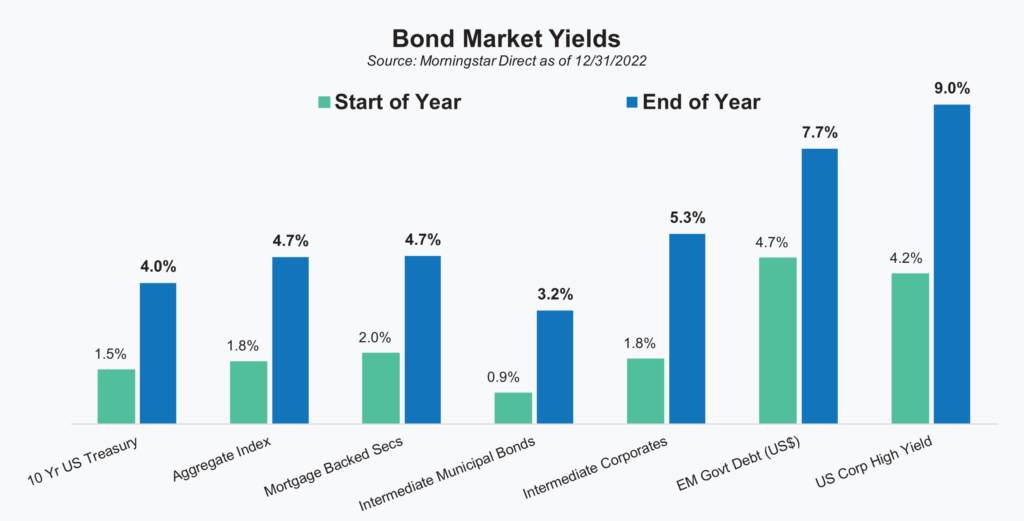

What are current bond yields and how do they compare to what they were 12 months ago? Current bond yields are materially higher than where they were just 12 months ago. Generally speaking, bond yields haven’t been this high since the outset of the financial crisis. Yields could certainly still move higher, but at current levels we believe valuations are attractive and investors are being fairly compensated for that risk – something we haven’t been able to say in close to 15 years!

For investors tempted to wait until after the Fed is finished hiking rates to invest, we’d like to point out that the considerable increase in yields year-to-date and the Feds willingness to lay out its future plans likely means that much of what the Fed will ultimately do is already priced in. After beginning the year very defensively positioned (short duration/low credit risk) we have already begun to adjust our positioning to take advantage of the increase in both yields and credit spreads. We wouldn’t characterize our positioning as aggressive by any stretch of the imagination, but we are methodically becoming less defensive the more rates increase.

Commodities + Real Assets (+ Alternatives)

We recently expanded this section of Your CFO Report to include a discussion on several alternative strategies that we use in managing portfolios. With stocks and bonds struggling for most of the year, these strategies have proved incredibly valuable. Collectively they’ve produced a positive return this year within portfolios and all five strategies have outperformed the more traditional markets that we compare them to and from which they are funded.

For a brief description of the three types of strategies please click here as we provided a summary on each last quarter.

We continue to believe that alternatives should play an important, diversifying role in a portfolio, but have a note of caution for investors now flocking to the space. As we’ve seen through past market cycles, advisors and investors tend to pile into Alternatives after the market has already declined. We not only view this as reactive and backwards, but something that is ultimately harmful to long-term portfolio returns. Rushing to “close the stable doors after the horse has already bolted” risks compounding the performance issues that investors are already faced with.

There has been a recent surge in marketing efforts and articles touting the benefits of alternatives and we fear that investors are doomed to make the same mistakes they made after the tech bubble and financial crisis. We certainly encourage investors to explore alternatives and educate themselves, but most investors would be better served to “put a pin in it” rather than rush to make major portfolio shifts now.

Our alternative holdings remain a core part of our process and portfolios, but to give investors a sense of how we think such strategies should be utilized we’ve been reducing our allocations over the past year. We’ve used strength in the positions to opportunistically rebalance and reposition parts of the portfolio back into traditional stocks and bonds as valuations in those markets became more attractive.

Being a long-term investor doesn’t mean never making adjustments or changes. The reason we hold alternatives in the first place is to help protect against the inevitable swings in traditional stocks and bonds, but now that we’ve experienced one of those difficult periods we don’t need as much “protection”. Ultimately it should also help in capturing more of the upside when those traditional markets eventually do recover.

While we are very pleased with how our strategies have held up during this difficult period, we know what matters to investors at the end of the day is the bottom-line. We understand and appreciate that. We can’t know or say when, but markets eventually will recover and portfolios along with them. Like you, we look forward to that day!

As always, our team of advisors is available and ready to answer your questions on these or other topics related to investments and financial planning. Please call us at 404-874-6244 or email us here.

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Back to Insights

Back to Insights