Market Recap – Volatility Settles Down | Second Quarter 2018

by: Smith and Howard Wealth Management

In a Nutshell:

The volatility experienced early this year settled down to a more “normal” level during the 2nd quarter, but returns in major asset classes and market segments continued to flip-flop between positive and negative as they have done throughout the year. At quarter’s end, both equities and bonds posted flat returns and remained close to where they began the year. As always, there were outliers that included the outperformance of U.S. stocks relative to international, growth stocks compared to value within the U.S., and impressive rebounds in both REITs and energy pipelines.

For an in-depth look at the market for the quarter just ended, read below.

Market volatility leveled off during the 2nd quarter, but that was more reflective of just how extreme 1st quarter volatility had been. The volatility experienced early this year settled down to a more “normal” level during the 2nd quarter, but returns in major asset classes and market segments continued to flip-flop between positive and negative as they have done throughout the year. At quarter’s end, both equities and bonds remained close to flat on the year. As is typical, however, there were segments that separated from the broad markets; we’ve highlighted a few of those in the following commentary.

Equities

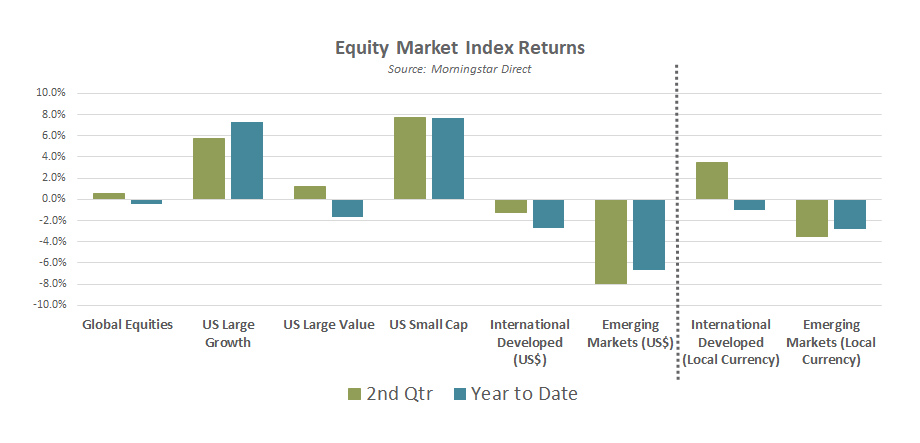

The global equity market advanced slightly (+0.5%) during the quarter but remains down on the year at -0.4%. The rather modest returns mask the amount of volatility investors experienced during the quarter and obscure the fact that various market segments did post more notable returns. As the accompanying graph illustrates, there were a few broad themes to equity market returns during the quarter. The first is the continued dominance of growth stocks relative to value stocks within the U.S. market. The outperformance of growth has been driven primarily by the strong sector performance of Technology and Consumer Discretionary stocks. These two sectors are the largest sector weights in the large growth index and have been the two best performing sectors in the U.S. this year. Interestingly (if not also surprisingly), the performance of the Consumer Discretionary sector was driven by two names most would expect to be considered technology stocks, Amazon and Netflix.

Another noteworthy performance difference can be seen between the U.S. and international markets. Global markets had generally been in sync over the past year, but that began to change during the 2nd quarter. As global trade rhetoric escalated, international equities experienced weakness. Much of that weakness can be attributed directly to the strength in the U.S. Dollar, which rose more than 4% on the quarter versus a trade-weighted basket of foreign currencies. In the Equity Market Index Returns graph, we’ve shown the performance of International Developed and Emerging Market equities in both U.S. Dollar terms and in Local Currencies (far right). The currency impact was the only reason International Developed markets were down and was responsible for a good portion of the fall in Emerging Markets. While currency doesn’t tend to be a significant contributor to long-term returns, it can and will have an impact over shorter time periods.

Bonds

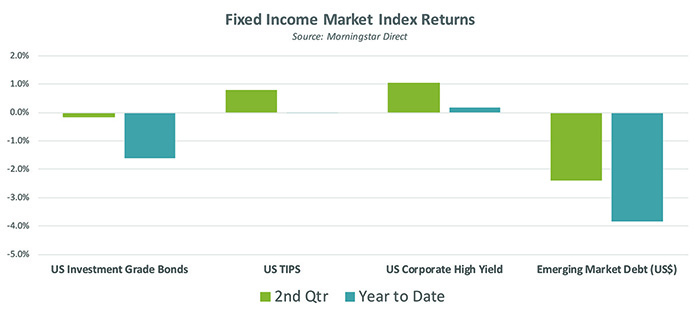

As with equities, broad fixed income returns (-0.2% for the BarCap Aggregate U.S. bond index) don’t tell much of the quarterly story. The yield on a U.S. 10 Year Treasury bond began the quarter around 2.74% and moved as high as 3.12% during the quarter before falling back to 2.85% to end the quarter. While there isn’t any magic to the 3% level it did garner a significant amount of market and media attention as we pushed through it. The Fed again raised short term rates and the yield curve continued to flatten. Shorter maturity bonds have moved higher in yield while longer dated bonds have been slower to react (See chart in Market Outlook section).

More opportunistic strategies, which often focus on lower rated corporate credit and non-traditional bond sectors, continued to fare well as credit spreads remained tight. One notable exception to this was in emerging market debt. Emerging market debt fell -2.4% during the quarter due to concerns about global growth and increasing interest rates in the U.S. This past quarter continued to highlight the current dilemma of bond investors’. Who may be anxious to lock in higher bond yields. For that to happen, there will likely be periods like the quarter just passed, where returns are flat to negative as rates increase.

Commodities and REITs

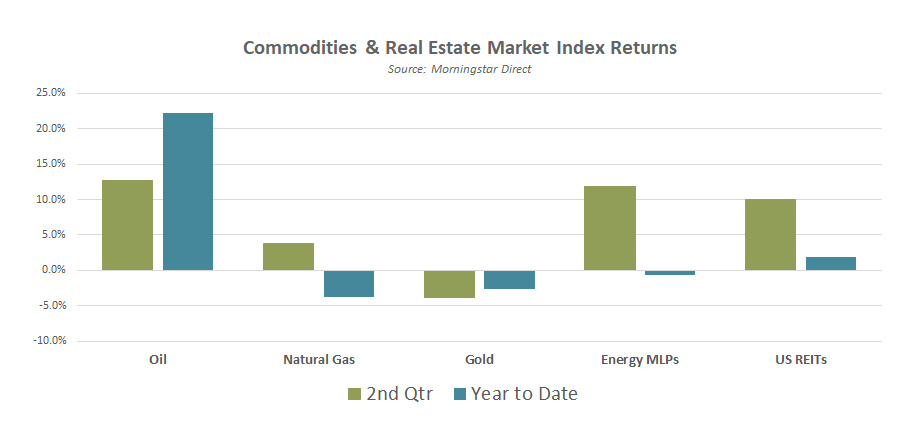

Unlike stocks and bonds, the volatility during the quarter is quite evident in the 2nd quarter results for commodity and real estate related strategies. While that was mostly a positive for investors during the quarter, the full year-to-date results still resembled the less impactful returns that have been seen in stocks and bonds. The 1st quarter had been particularly difficult for several commodity and real estate segments, so the rebound during the quarter essentially reversed that weakness. Oil prices have continued to move higher with a significant portion of that move towards quarter-end as it became clear that OPEC members would only marginally increase oil production. A casualty of higher bond yields in the U.S. appears to be gold. As cash yields move higher, the opportunity cost of holding gold instead of cash likely caused some investors to abandon or reduce gold holdings. After a flat 1st quarter, gold fell close to 4% during the 2nd quarter.

To learn more about the effects a less volatile market has on returns in major asset classes, contact Brad Swinsburg 404-874-6244.

Explore more information on the second quarter of 2018 by visiting these links:

Market Outlook: Second Quarter 2018

A Deeper Dive – What is the market going to do this year?

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.