A Deeper Dive – The Impact of Rising Interest Rates | 1st Quarter 2018

by: Smith and Howard Wealth Management

In a Nut Shell: Investors tend to closely follow movements in the stock market, but over the past two quarters we’ve witnessed some interesting developments in bonds as yields have moved higher. While there is no certainty that rates may have finally begun the long-anticipated climb higher, there is one notable difference distinguishing this most recent move from others that fizzled out over the past decade. The Federal Reserve has made it clear that they are finally on a path to “normalizing” rates after nearly a decade of easy monetary policy.

The change in policy and rates has understandably prompted questions and concerns from clients about what exactly this means for markets and portfolios. As with most things in the investing world some impacts are straight forward, but most are not.

For insights on our thinking regarding higher interest rates and bond yields, read below.

When investors, advisors, and the media talk about the “market” it is typically in reference to the stock market. That is perfectly understandable as that is the primary driver of portfolio returns, as well as portfolio risk. While the bond market dwarfs the equity market in terms of size (total $’s) it takes a backseat to equities in most every investing discussion. Even discussions regarding the Federal Reserve and their increases to the target interest rate often focus more on the impact to stocks than bonds. Stocks are bound to remain front and center, and for good reason, but recent movements in interest rates and bonds is deserving of increased attention.

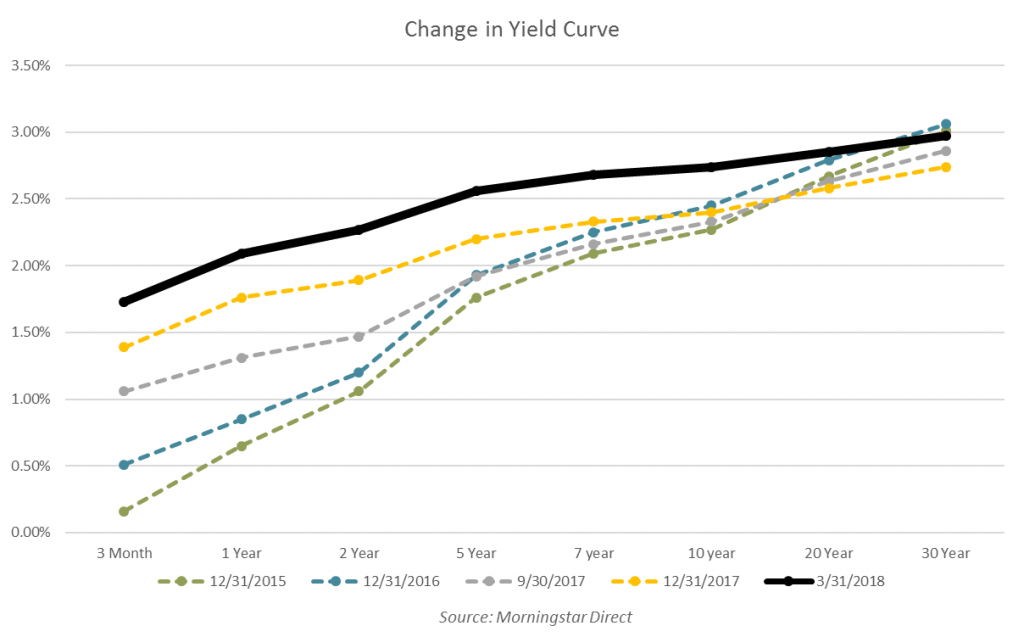

Since the depths of the financial crisis market pundits have debated when interest rates will begin to climb and how far they may eventually go. Until recently those debates appeared to be mostly philosophical. While interest rates have had periods in which they briefly moved higher the last few years there is a notable difference with the latest increase in yields. The Federal Reserve and its “normalization” program is now in full swing, shows no signs of slowing and even some signs of speeding up. After nearly a decade of the most accommodative monetary policy in U.S. history, the Fed has raised rates 6 times (0.25% at each increase) since December of 2015. As the increases to rates has picked up speed, so has the impact to the overall bond market as can be seen in the below chart.

In the above chart we are showing U.S. Treasury bond yields for varying maturities. Moving from left to right shows shorter maturities (3 months) to longer maturities (30 year) at different points in time starting with the end of 2015. For example, following the dotted green line from left to right would tell you what yields were on 12/31/2015 for various maturities (X axis) of U.S. Treasury bonds. The additional lines show how those yields have changed with the thick black line showing where they were at the most recent quarter end. While longer maturity bond yields are still relatively unchanged, shorter maturity bonds have moved rather significantly.

What does all this mean for investors? Some impacts are more direct and certain than others, but we thought some big picture, bullet point thoughts organized into what we might consider positives and negatives would be helpful.

Let’s get the negatives out of the way first:

Now for some positives (which are always more pleasant to discuss):

As someone who started his career as a credit analyst I tend to be more interested in what is happening in that world than most. Talking about interest rates and bonds, however, isn’t exactly the kind of thing that gets one invited to social gatherings! I’m still not expecting that to change anytime soon, but if the Fed and rates continue on their current path it is likely to draw increasing attention from all investors.

For more insight on what we feel the Federal Reserve’s change in policy and rates mean for markets and portfolios, please contact Brad Swinsburg 404-874-6244.

Explore more information on the first quarter of 2018 by visiting these links:

Market Recap: First Quarter 2018

Market Outlook: First Quarter 2018

On the Horizon: Seven Focus Areas

Unless stated otherwise, any estimates or projections (including performance and risk) given in this presentation are intended to be forward-looking statements. Such estimates are subject to actual known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from those projected. The securities described within this presentation do not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in such securities was or will be profitable. Past performance does not indicate future results.

Subscribe to our newsletter to get inside access to timely news, trends and insights from Smith and Howard Wealth Management.